Canadian Grocer's 2023 Produce Operations Survey: Labour and sustainability

As if multiple years of a global pandemic weren’t enough to throw grocers off track, last year’s extreme weather conditions and burgeoning recession have contributed to particularly taxing times in the grocery sector, especially in fresh foods. But, as our fourth-annual Canadian Grocer Produce Operations Survey reveals, produce sales continue to stabilize and grocers are optimistic about being able to meet the needs of Canadian grocery shoppers – even with ongoing supply chain issues.

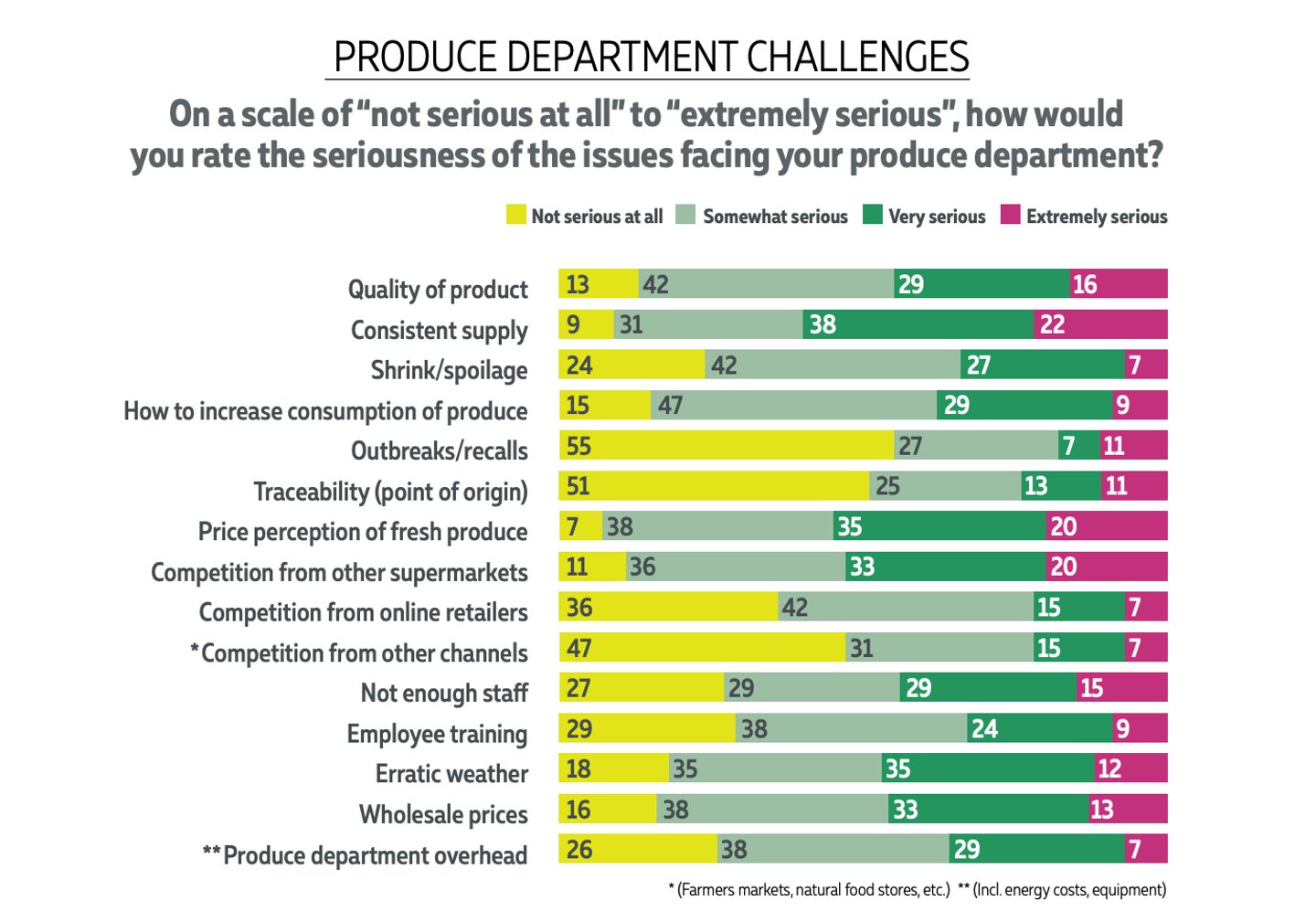

In asking grocers across the country about what’s happening in their produce departments, the consensus was clear: even as consumers become more and more cost-conscious, produce is still an essential part of grocery baskets. The question now is how to meet expectations going forward while keeping produce departments profitable.

This is part two of a three-part report. Read part one here and part two here.

Tackling waste, sustainability and staffing

Along with the supply chain issues plaguing survey respondents were concerns around food waste and shrinkage. More than half of those surveyed said they were donating to food banks and more than one third have partnered with food rescue services. Using produce in fresh-cut programs and prepared foods were other popular tactics for minimizing food waste. One survey respondent noted that they offer produce to staff when they can’t donate it right away.

In terms of shrinkage, 23% said they are using technology to better forecast and reduce surplus. Ron Lemaire, president of the Canadian Produce Marketing Association (CPMA) also points to the importance of educating produce staff to ensure there is proper cold chain management in the back of the store to sustain product quality, along with optimal presentation up front. “It comes back to clear training and understanding of product rotation, making sure you are culling and refreshing product regularly to present it in the best possible way,” he says.

READ: Grocery leaders share how they’re prioritizing their sustainability efforts

Sustainability is also top of mind as consumers revert back to environmental issues that were paramount prior to the pandemic. Almost 68% of grocers surveyed said they planned to implement policies to reduce plastic packaging and waste in the produce department, compared to 54% last year, although 70% of respondents said the use of plastic in this department has stayed the same. Lemaire says all generations are concerned about sustainability, but younger generations, in particular, are looking to fair and ethically traded products, even beyond organic and fairtrade, to ensure conventional products are produced using the appropriate practices.

According to a recent CPMA survey asking consumers to identify who bears the responsibility for driving change in sustainable packaging, the biggest push was on producers and retailers. However, Lemaire points out that change needs to happen across the entire supply chain. In addition to improving recycling channels overall, he says one of the key challenges for the produce sector over the next two years will be in working with producers to develop food-grade recycled materials without driving up costs exorbitantly. “So, we’re not just looking at it in silos, but across the entire spectrum of the system,” he says. CMPA launched an online tool in April for the produce industry and others across the food sector that Lemaire says will “help them navigate how best to develop sustainable packaging and all the steps they need to take.”

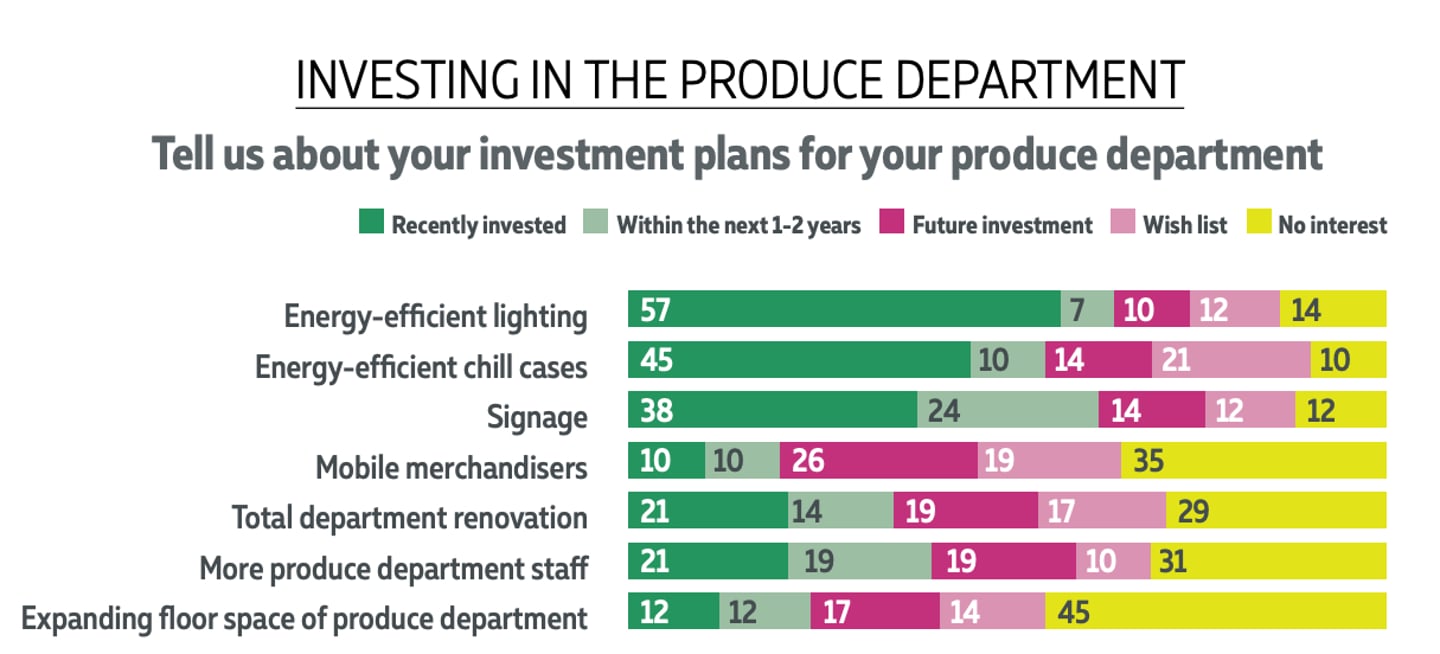

Labour shortages in produce departments continue to be a problem, although the number of respondents citing “not enough staff” as a very to extremely serious issue has dropped to 44% from 67% last year. Among survey respondents, 21% have recently invested in produce staff and another 19% plan to do so in the next one to two years.

READ: Canada's food industry has an appetite for innovation

Giancarlo Trimarchi, president of Vince’s Market, attributes good retention rates in the produce department at Vince’s Market to management taking sufficient time to properly train and support staff. “Produce is the one department in our store that we never undercut because the nature of the product and its handling has to be right at all times,” he says. “We always make sure our wages in produce are generous, too, because we recognize it can be a profit centre for us.”

Aside from investments in staff, Canadian grocers also noted recent investments in their produce areas. Energy-efficient lighting and chill cases topped the list and more than one quarter of grocers surveyed said they would be investing in mobile merchandisers for the future. More than one third also plan to renovate the total produce department, with 21% having done so recently.

In optimizing their produce departments, grocers will also have a bigger role to play in educating consumers around proper ways to store items to maintain shelf life, says Rick Stein, vice-president of fresh foods at The Food Industry Association (FMI). “You have a lot more younger shoppers now who don’t understand all the produce products or what their benefits are and they need more information,” he says.

Technological innovations already in the works – where shoppers will scan codes with their phones for nutrition information and storage tips – will help, but until those are more mainstream, he says it’s up to grocers to help keep shoppers better informed on fresh foods.

This article first appeared in Canadian Grocer’s March/April 2023 issue.