Canadian Grocer’s 2024 Produce Operations Survey: Pain points and opportunities

The good news is that produce sales are growing for many grocers across the country and most expect continued growth throughout this coming year, according to Canadian Grocer’s annual Produce Operations Survey. The bad news? Key challenges prevail in this pivotal part of the grocery store. Those grocers who are finding success despite these pain points have learned to adapt to changing consumer tastes and have innovated to find new value-added revenue sources.

Here are highlights from our fifth-annual survey along with insights from industry experts and grocery retailers on changing trends and opportunities in produce.

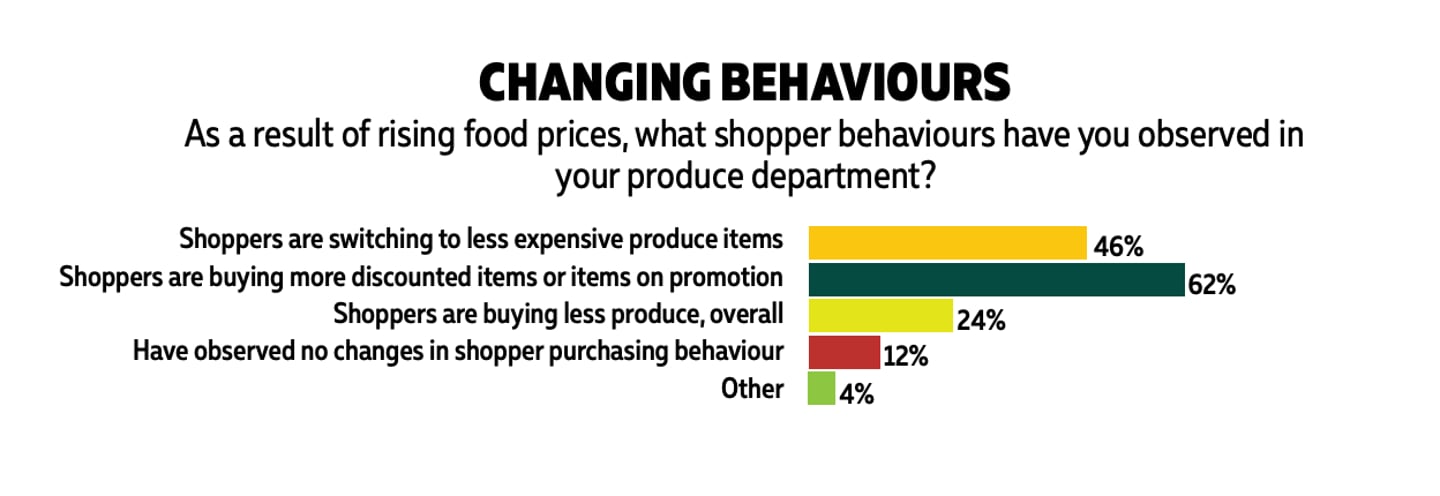

Changing behaviours

It’s no surprise that higher food prices are changing shopper behaviour at the grocery store, with produce being no exception. Most grocers surveyed (62% compared to 47% last year), said shoppers are buying more discounted items or items on promotion, and 46% versus 35% in 2023 said shoppers are switching to less expensive produce. Nearly one-quarter of grocers this year said consumers are buying less produce overall.

According to The Power of Produce Report 2024 released in March by U.S.-based The Food Industry Association (FMI), three-quarters of consumers believe fresh produce costs more despite below-average inflation. Price, ripeness and appearance are the biggest drivers in produce sales, with health benefits earning a six-point lead above nutrient content.

The fact produce servings have dropped to less than three per day from under four in 2022 is very concerning, says Ron Lemaire, president of the Ottawa-based Canadian Produce Marketing Association (CPMA). “Not only relative to sales, [but] we know the long-term impact on consumer health,” he says. A CPMA report on the economic burden attributed to low fruit and vegetable consumption in Canada shows that a drop of even one serving per day will eventually equate to a billion dollars in increased healthcare costs.

READ: Many Canadians still feeling squeezed even as debt worries ease

CPMA has been working with dietitians, healthcare professionals and consumers across Canada to help quell high price perceptions around produce and educate shoppers on what they can buy for just $20. “We’ve seen consumers make purchasing decisions based on flyers, which really tells [the] industry how we have to look at our flyer program,” Lemaire says. “How are you meeting the sweet spot of reaching the price-sensitive consumer in a price-sensitive environment, while ensuring they stay in fresh … which is still a driver category for the entire store?”

Thomas McDonald, produce department manager and co-owner of The Village Grocer in Markham, Ont., says he spends significant time educating consumers about quality produce and why some items are worth paying a premium for. In addition to putting together a weekly flyer that “people read religiously,” he sends out a produce report every Thursday via social media to let shoppers know what they should and shouldn’t be buying at different times of the year. “In the videos I talk about growing conditions, quality and how to pick items when they come into the store,” he explains. “You can’t just put something with a giant price tag on the produce floor and expect people will know what to do with it.” It’s clear these tactics are paying off. “We promote Spanish strawberries at $25 a flat and we can’t keep them on the shelves,” says McDonald.

Issues with supply, quality and shrink

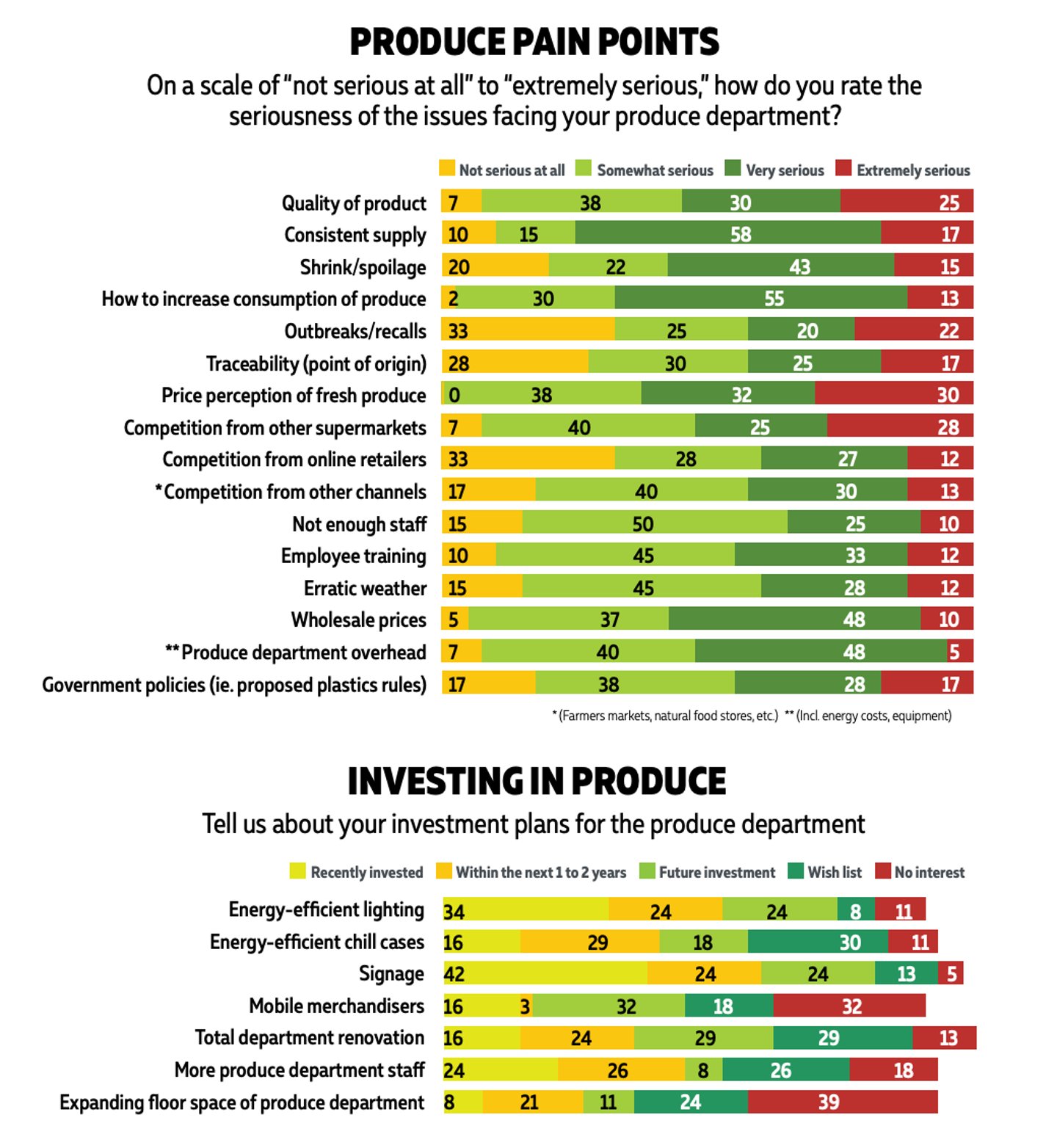

On top of challenges around produce costs are the quality and consistency of supply, according to Canadian Grocer’s survey. “The most challenging part our department faces is the condition we receive our supply in,” said one survey participant. More than half of respondents said shrink is about the same as last year, with 20% noting it is increasing.

Will Willemsen, founder of Sunripe Freshmarket, says poor weather is always an issue in produce as it inevitably brings quality down and prices up. He has managed to offset quality issues to some extent by focusing on carrying only the best produce he can find for his three Ontario-based stores. “I go to the [Ontario] Food Terminal twice a week and pick everything myself to make sure the quality is consistent,” he says. “We also taste everything to make sure the quality is a step above.”

Willemsen believes the real innovation in produce is finding that delicate balance between having the right quality produce, the right displays and the right people to execute the store’s produce initiatives. “If you can click on all of those, that will drive produce sales,” he says.

READ: Shoppers turn to ‘imperfect produce’ as grocery prices rise

To keep shrink down, Willemsen’s stores are also making more prepared/value-added items from produce, be it cut fruits and vegetables or store-made salsa and guacamole made from culled produce items. “This keeps the loop going and cuts down on waste,” he says. “Anything people can grab and eat without lots of prep is growing exponentially in our stores.”

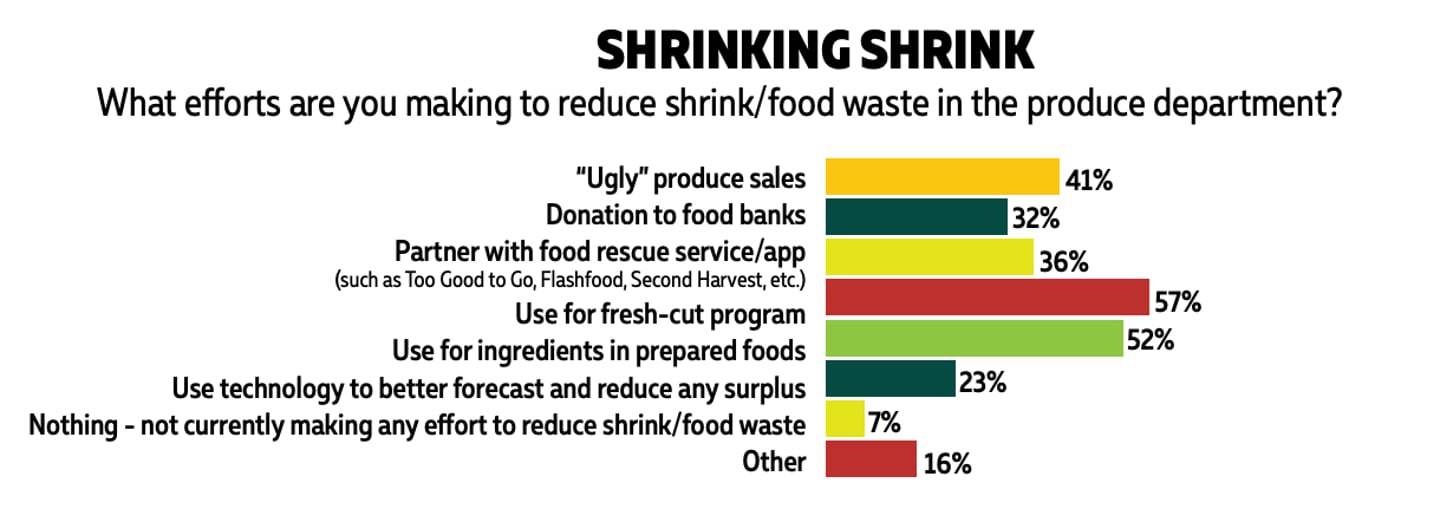

More than half (57%) of grocery retailers we surveyed this year said they are reducing shrink and food waste by using excess produce in their fresh-cut program, followed by 52% who are using it as ingredients in their prepared foods, and 41% said they are relying on “ugly” produce sales. One survey respondent said: “We put ugly produce in discount bags for people to buy, while all unsellable produce is put in banana boxes and is available for farmers to pick up and use to feed their animals.” Another respondent said investment in bin programs has enabled them to push tonnage without any increase in shrink rates.

Labour challenges prevail

Finding reliable, motivated staff is another key pain point across grocery these days and it’s especially challenging in the produce department. Three-quarters of respondents cited “not enough staff” as a somewhat serious or very serious challenge, with another 10% noting it as extremely serious.

There is a repetitiveness and attention to detail needed in produce that isn’t as urgent in other grocery departments, says Giancarlo Trimarchi, owner of Ontario-based Vince’s Market, whose four stores employ more than 270 people, 45 of whom are dedicated to produce. “The person doing it has to understand the different levels of quality for a produce item and know when it’s time to take it off the shelf and put it in the back room for processing,” he says. With produce accounting for 38% to 40% of total store sales, Trimarchi says there is a lot of effort put into training produce employees. “We also make sure they’re rewarded with a good compensation level compared to other stores and other departments and that has helped us develop and retain talent,” he says.

On a broader level, CMPA’s Lemaire says it’s essential for produce procurement and merchandising teams to work collaboratively so there is synergy across the supply chain. “The two have to work harmoniously to make sure decisions can be made quickly and effectively when trying to drive new or existing products,” he says.

As for front-of-store produce staff, Lemaire says proper training is essential. “How I am trimming product, displaying it and answering consumers’ questions is key because that front face of the produce department is the difference in someone picking up an extra head of lettuce or not.”

Further opportunities to grow sales

When asked about recent investments in the produce department, 42% of respondents said signage was top of the list, followed by energy-efficient lighting, more department staff and energy-efficient chill cases. In looking at the biggest opportunities to grow produce in the next six months, grocers had consistent supply and quality, more local offerings, more value-added items and aggressive flyer pricing on their list.

Kimberly Roberts, senior director of merchandising, produce & floral at Walmart Canada, says the demand for fresh produce continues to grow at Walmart stores and the retail giant is focused on providing customers with both value and quality. “When they walk into a Walmart, we want them to be amazed by the freshness of our produce and the quality of the offerings, all at our everyday low prices,” she says. “We’re continuing to drive innovation and excitement in produce as we are across the store.” That includes introducing items to expand shoppers’ palates such as Your Fresh Market Smitten apples, a modern apple variety developed in New Zealand.

With snacking on the rise, the produce department is also a great way to give consumers new ideas for snacking, says Rick Stein, vice-president of fresh foods at FMI. The association’s The Power of Produce Report 2024 showed that 51% of produce shoppers said they would like tips on ways to incorporate fresh fruit and vegetable snacking. “There are a lot of produce items that fit really well into that, from Tom tomatoes to baby carrots, celery and dips,” he says.

READ: A look at what continues to drive the craze to graze

With consumers looking at value beyond just price, he says grocers should be thinking about whether their produce departments are experiential enough, with locally grown items, product sampling and convenient ways to enjoy fruits and veggies, he says. “We can swing out of these doldrums everyone is feeling because the growth isn’t as great as it was before COVID, but only if we zero-in on how the consumer feels around value.”

More and more Canadian grocers are also recognizing the value in adopting more environmentally friendly tactics in their produce sections, with 45% of our survey respondents saying the use of plastics has decreased. Over the next 12 months, almost 60% said they were planning to implement policies reducing plastic packaging/waste in the produce department, too.

This increased environmental focus by grocers aligns with consumer stats from FMI’s report showing 47% of consumers prefer to purchase bulk produce over packaged. More size variety in purchasing pre-packaged produce is also gaining favour among consumers, especially gen Zs and millennials. The report shows package size variety could be a solution to address various household sizes, affordability and waste.

Technology in produce on the rise

When asked how they are using technology to improve efficiency in produce, Canadian grocers noted using it for forecasting, tracking shrink and just-in-time ordering. Some are also using shelf-tags, as well as real-time data to track productivity and production of value-added items.

READ: How tech is helping produce and profit margins

FMI’s Stein expects technology to shine in many ways for produce in the future, starting with improvements in operations. “It’s about how do I make sure I have the freshest produce on hand and on time,” he says. Online shopping is another element that has done pretty well in produce, says Stein. “There are some consumers who would rather pay someone to do their shopping for them and pick out the best bananas or avocados – they trust them better than they trust themselves.”

He adds that technology is a great tool with which to communicate with consumers to build loyalty and offer more value. “What we’ve seen, overall, is that consumers are using apps in a pre-shop way to decide where they’re going to go,” he says. Be it mobile apps or grocery websites, he advises grocers to use technology to educate consumers on meal ideas and nutrition information around produce. “I think there is a lot of depth still to be realized in using technology in grocery,” he says.

This article first appeared in Canadian Grocer’s March/April 2024 issue.