2024 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours (part one)

From where they’re buying groceries to what’s in their basket, their biggest pet peeves at the store and much more, we teamed up with the research group at EnsembleIQ (Canadian Grocer’s parent) to get a handle on how Canadians size up the grocery shopping experience. Shoppers all across the country were surveyed to bring you our fourth-annual 2024 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours.

Below are some highlights from the study. Read part two here.

Sticking with discount

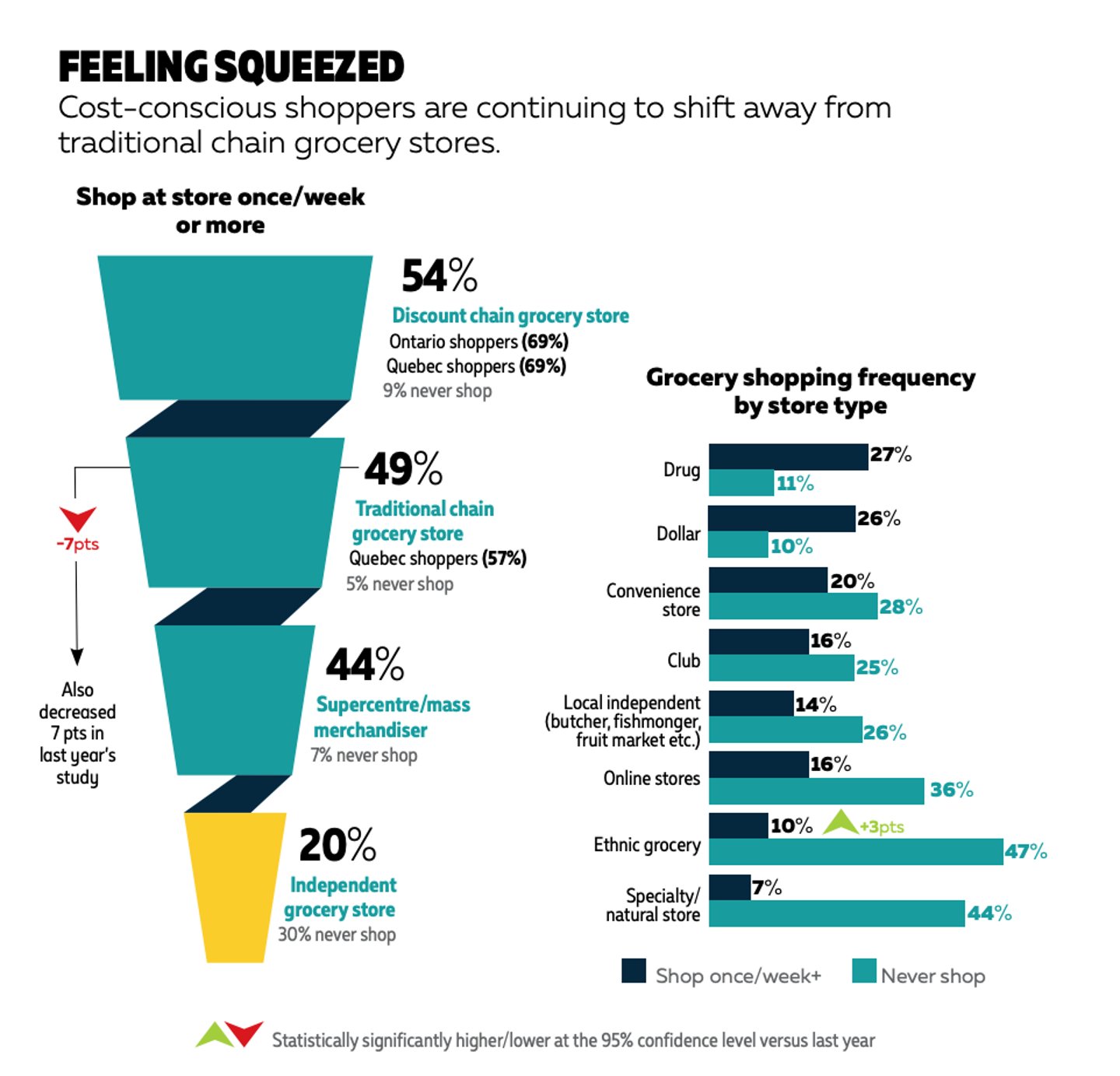

Saddled with household debt and still struggling with the high cost of living, it’s no surprise that to cope, Canadians are adjusting their behaviour, and that includes how they shop for groceries. In fact, the latest edition of our Grocery IQ Study finds that shoppers in Canada are continuing to shift away from traditional grocery, with just 49% of shoppers surveyed reporting they shop at these stores at least once a week; this is down 7% from last year (and down 14% from our 2022 study).

To stretch their dollars, 54% of shoppers are sticking with discount grocery stores, which are proving even more popular with shoppers in Ontario and Quebec, where 69% of shoppers in these provinces say they visit discounters once a week or more. Supercentres/mass merchandisers, independent grocers, dollar stores and ethnic grocery stores all experienced a slight lift in terms of the number of people shopping them at least once a week, compared to last year.

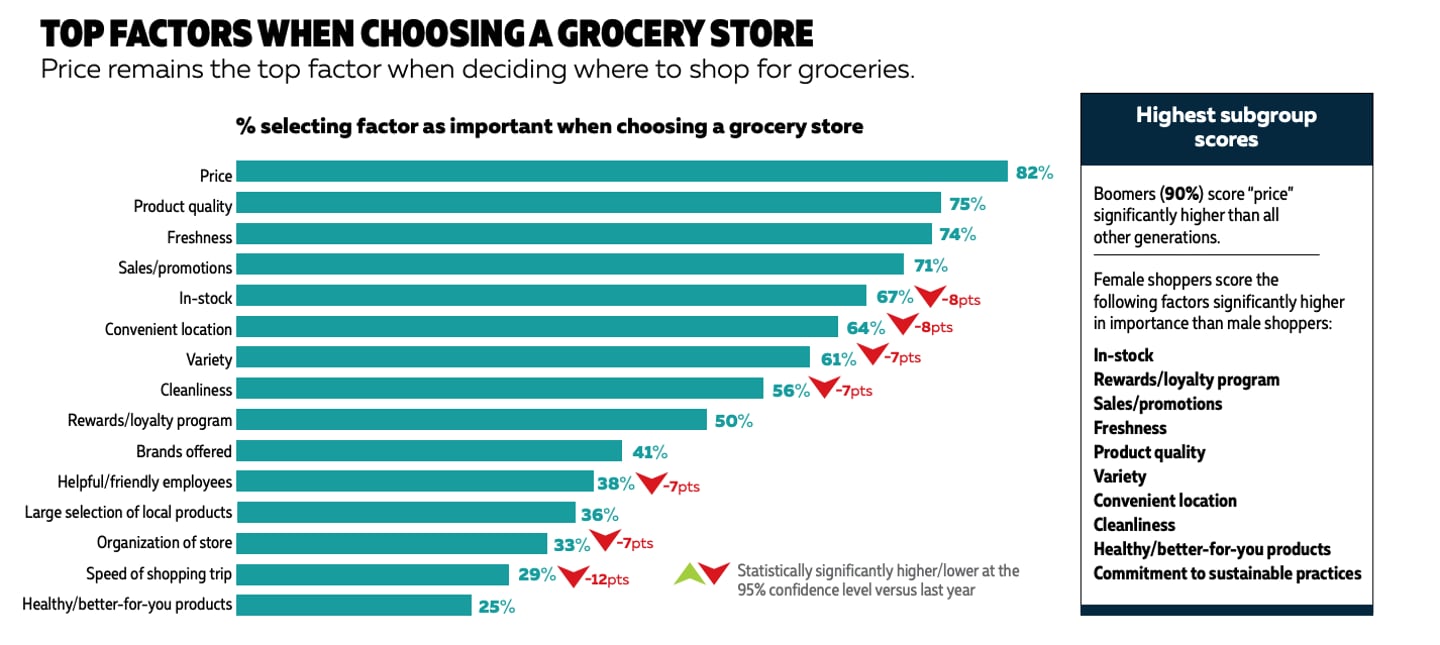

With shoppers feeling squeezed financially, it makes sense that for 82% of survey respondents, price remains the most important consideration when deciding where to shop (90% of boomers said it’s the most important factor). Although shoppers appear to be laser-focused on price, factors such as product quality and freshness held steady at 75% and 74%, respectively. Interestingly, among survey respondents, factors such as convenient location, variety of products available, and speed of the shopping trip have dropped in importance year over year.

Sizing up the store

When asked to rate the performance of the store they shop at most often, overall, shoppers felt about the same as they did last year. In terms of such things as cleanliness and variety of products on offer, 60% of shoppers said their store was doing an excellent job and, compared to last year, shoppers surveyed were slightly more satisfied with employee friendliness/helpfulness.

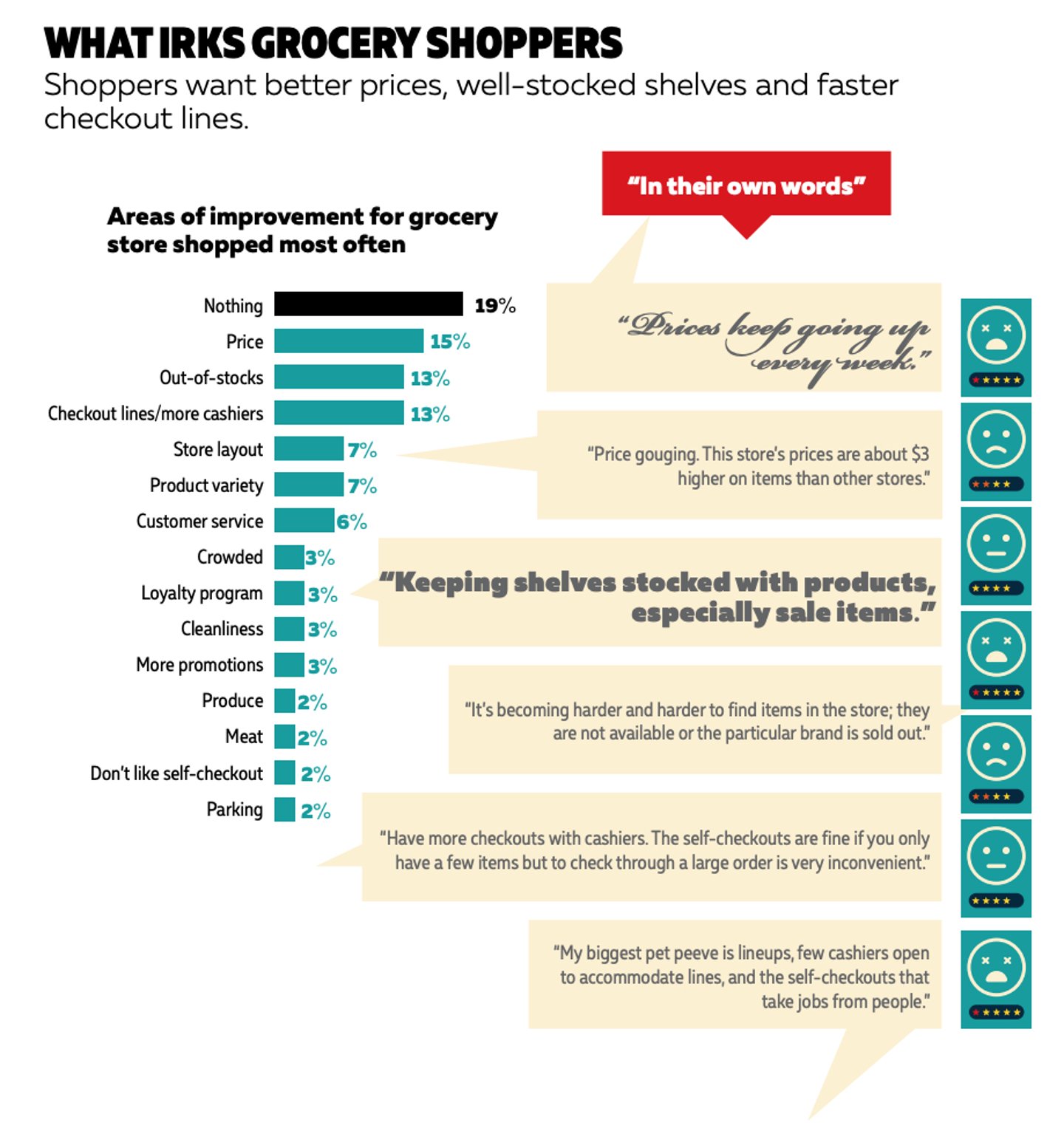

And while the good news is that 19% of shoppers said they wouldn’t change anything about their primary store, 15% said grocers need to do a better job on price. In verbatims captured, survey respondents complained of “prices going up every week” and “price gouging,” suggesting grocers have work to do when it comes to explaining their prices to customers. Other things that irk shoppers are out-of-stock items, long checkout lines and not enough cashiers at the store.

Locking in loyalty

As the battle to win customer loyalty plays out, grocers continue to tinker with their programs in hopes of keeping customers engaged, rewarded and coming through the door again and again. And grocers are getting creative with things such as subscription models, finding ways to reward customers beyond groceries and through gamification to woo younger shoppers.

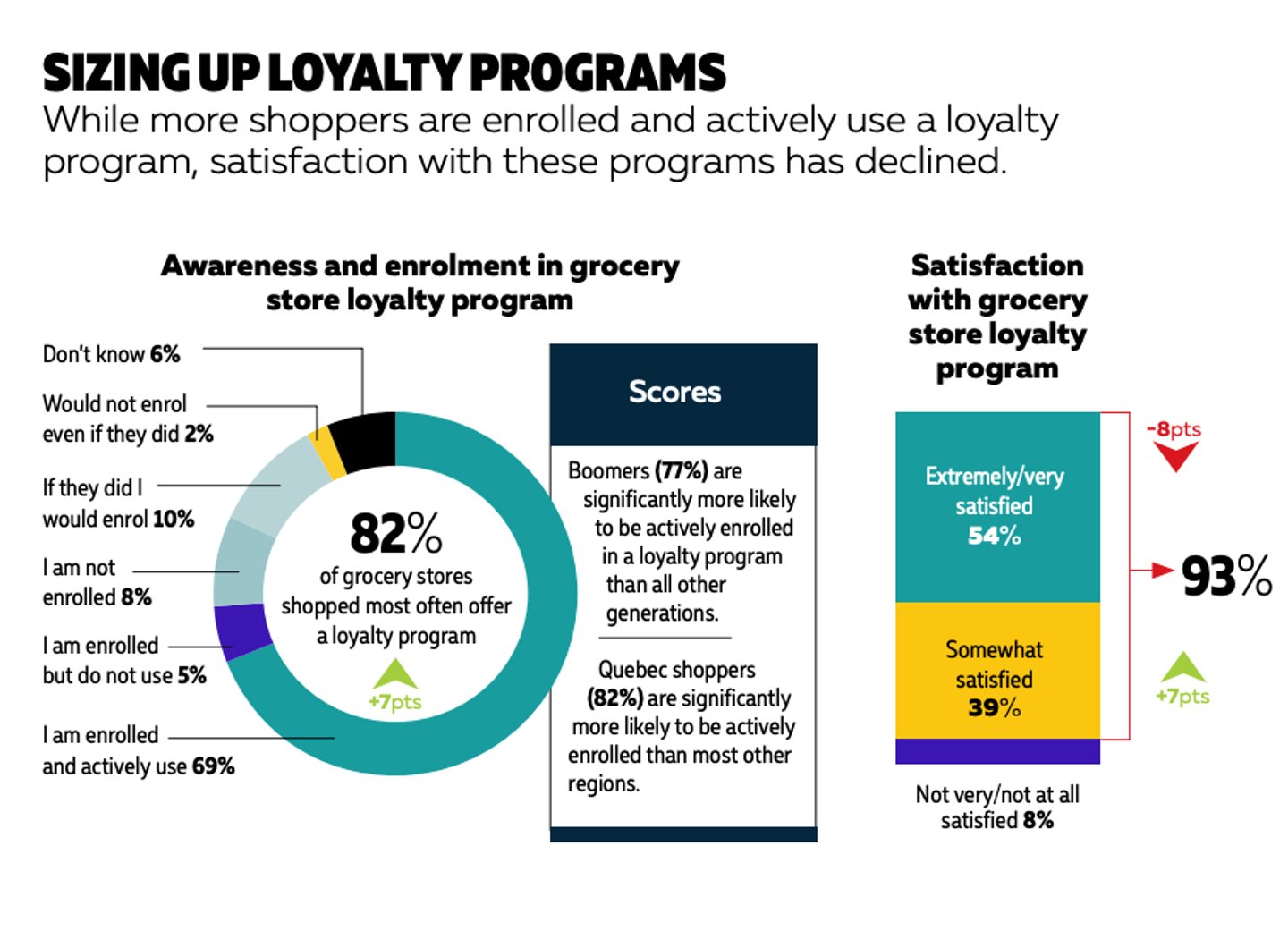

So, what do shoppers think of these measures? According to the study, awareness and enrolment of loyalty programs increased to 69% (from 67% last year), with 93% of those currently enrolled in a program expressing some level of satisfaction with it. It’s worth noting, however, that the number of shoppers indicating they are “extremely/very satisfied” with their store’s loyalty program fell significantly to 54% this year, compared to 61% last year.

Why the drop in satisfaction? Respondents said it had become harder to earn points with the program they’re enrolled in and that there were fewer discounts and bonus offers available. When asked what features of a store loyalty program they find most valuable, reward points that can be redeemed for groceries topped the list with 68% of respondents. Exclusive loyalty member discounts, however, increased significantly with this feature, appealing to 46% of shoppers, up from 40% last year, presenting an opportunity for grocers to use this as a retention tool.

Overall, 36% of shoppers said cash back on purchases was the most valuable feature, but among Quebeckers this ranked significantly higher at 55%. And what about flyers? It will surprise no one that in the digital age, paper flyers continue to lose relevance; in fact, just 34% of shoppers said they look at paper flyers before heading to the store, that’s down 9% from last year. While 50% said they look at digital flyers prior to shopping, it’s worth noting that a growing number of shoppers (21% versus 17% last year) don’t use flyers whatsoever.

This article first appeared in Canadian Grocer’s February 2024 issue.

Overview & Methodology

- Survey sample: 1,000 grocery shoppers

- Respondents were required to be age 18+, reside in Canada, shop at grocery stores at least once a month and are the primary or shared decision-maker for household grocery shopping

- Quotas were established by province/ territory to accurately represent the population distribution of Canada