Shoppers Drug Mart's loyalty evolution

When Shoppers Drug Mart relaunched its loyalty program and linked its popular Optimum card to its new digital ecosystem earlier this year, some suggested they were a little behind the curve.

But for Shoppers, with its 10-million-strong loyalty program, getting it right out of the gate was more important than being the fastest brand out there.

“It was a very careful rollout,” said David Harrington, Shoppers vice-president, business analytics and Optimum, in a recent interview with Canadian Grocer's sister publication Marketing.

Harrington said the Optimum card was so “ingrained in the business” that Shoppers had to set out to “turn it on its head to make it into this sleek, one-on-one marketing machine.”

Up to the launch, Shoppers spent a lot of time listening to its customers—finding out what they wanted and what they didn’t want. And yes, that involved collecting data.

“You compare

With a new website as well, the bells and whistles have worked pretty smoothly on both the back—and front—ends.

READ: Shoppers Drug Mart drives digital with Optimum program

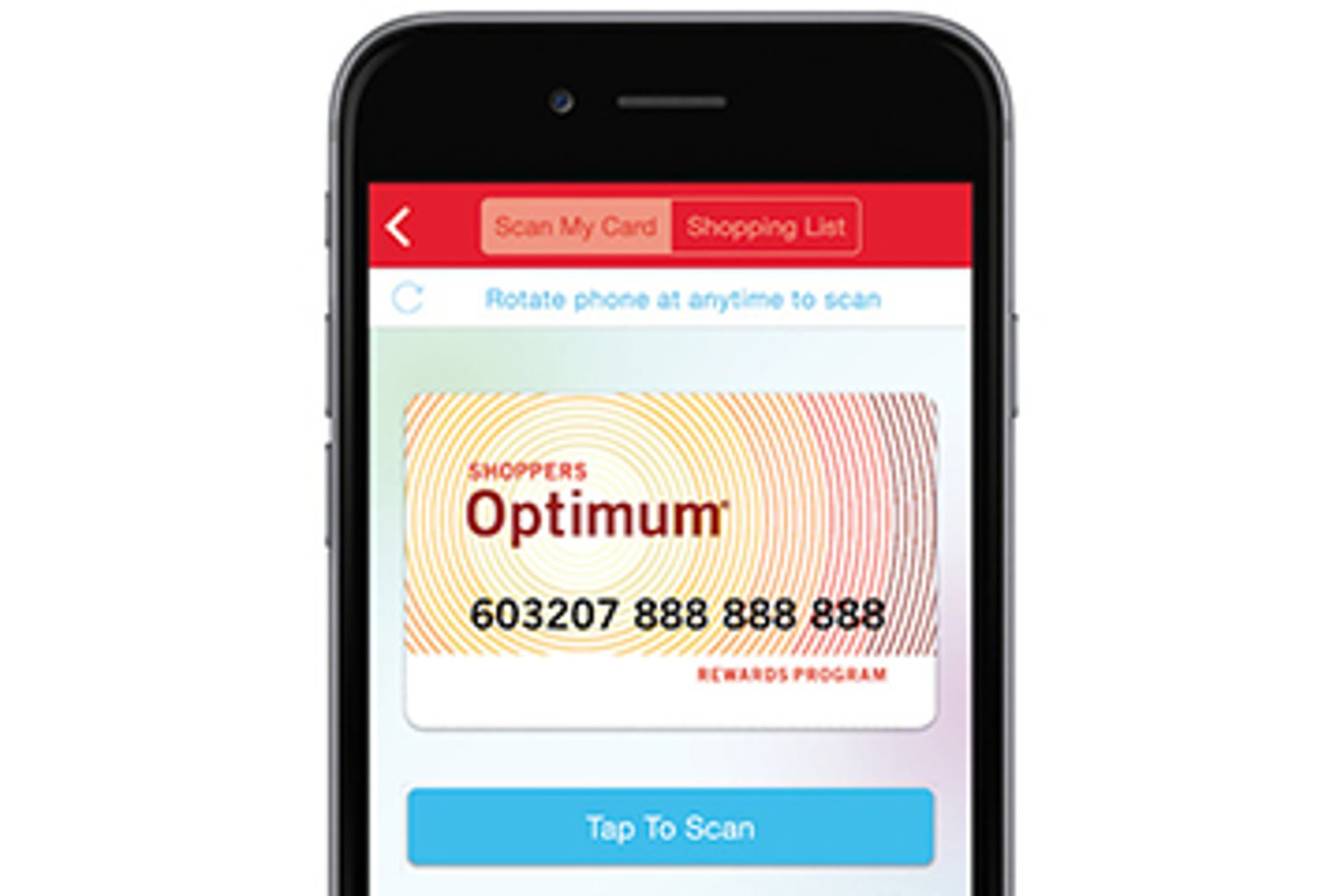

Previously, about two million customers got flyer emails, but they had to print the offers and bring them into the store. Now, personalized offers can be loaded into accounts via the app or online, and they become automatically linked to the account, so customers can use either their phones or their Optimum cards while shopping.

Shoppers Loyalty Program DigitalWhile printing flyers and bringing them into a store feels antiquated these days, Harrington said the old email program was vital to the new ecosystem. “That’s where we really got a sense of where the appetite was for more personalized communication,” he said.

And the digital transition—or evolution as Harrington called it—occurred at the right time, as customers have come to expect a one-on-one relationship with brands and retailers. And customers today are well aware that data is being collected. For many, implicit in allowing that collection from the retailer is the sense that he or she will get something in return for all the personal information they hand over.

“They expect it—they know that we know how they shop our stores, so in exchange for that, we’re highlighting the things that make sense for them,” said Harrington.

Making it easy to use was also key.

READ: How does Shoppers Drug Mart manage digital?

“We’ve adopted this notion of ‘Shoppers Knows You.’ When you log onto the website, there’s a personalized greeting, we show you how many points you have and we show you the offers that are available for you that week,” he said.

Another important aspect of the digital marketing strategy has been the need to maintain multi-channel flexibility. For all of the new digital infrastructure, many customers still use those trusty Optimum cards. Simply put, there is no “one-size fits all” approach.

“It’s not just about switching over. A large amount of customers that are participating in the digital world are accessing that program through multiple channels. An overwhelming number are using the app, the web or the plastic card,” said Harrington.

When asked about the data revolution at Shoppers and it’s effect on old-school concepts like sales funnels, Harrington stressed that messaging to customers remains a very nuanced —and human—discipline.

“In our environment, beauty is especially important to us: How we speak to our beauty customers, how we keep them abreast of all the innovation that goes on in the beauty space. That’s very important and it requires a more traditional marketing approach,” he said.

In other words, the basics aren’t going anywhere.

“We’re for sure a data-driven organization and all of our communication touch points are informed by data,” said Harrington. “But we have strong brand in Shoppers, in Optimum and in beauty that we need to continue to uphold and drive.”