The secret to Costco's success lies in supply chain efficiency

Check out Costco Wholesale’s key financial data for the end of 2013:

1. Net sales of US$102,870 billion

2. Net income of US$ 2,039 billion (1.98%)

3. 634 warehouse stores around the world

4. 6% sales growth over 2012

5.28,900 Gold members and 6,600 business members

6.Sales, general and administrative expense of 9.82%

Not bad for a company that opened its first warehouse store in Seattle in 1983.

Thirty years later, Costco is now the third largest grocery retailer in America according to Supermarket News. Costco had 2013 sales of $87.3 billion in the U.S. as compared $96.8 billion for Kroger (founded in 1883); and $274.5 billion for Walmart.

Costco Wholesale has operated in Canada since 1985 and is currently the country’s second largest retailer with 2013 sales revenue exceeding $13 billion despite having only 87 retail locations across the country.

The club membership concept is clearly a winning formula and perhaps the only downside is that there is a minimum population threshold required to support the sales throughput of a warehouse store.

Over the past 5 years, Costco Canada has only opened 10 new stores which is a small fraction of the 122 new stores opened globally during the same time period (Costco operates in the U.S., Canada, Mexico, United Kingdom, Japan, Taiwan, Korea and Australia). The average sales per Costco warehouse store is $100 million per annum ($1.92 million per week) so the Costco concept tends to be most successful in larger population areas.

Some people have criticized Costco for encouraging over-consumption by selling large quantity formats that force consumers to purchase more than their normal demand requirements.

I have personally experienced the phenomenon known as “cash register shock effect” on many occasions when checking out at my local Costco store. In the back of my mind, I know that I am coming out ahead, or at least I have convinced myself of this belief to justify my actions.

This begs the question: is Costco really cheaper than the traditional supermarket? Or are Canadians not smart enough to figure out that by consuming more they in turn are spending more in order to save more hence they are no further ahead?

Is Costco cheaper compared to conventional grocers?

This question is actually quite complex in that it has multiple answers that boil down to individual consumer behaviour. The reality is that Costco has perfected a purchasing strategy known as the “treasure hunt” which means that there are always new items and tempting deals that spontaneously come and go. The consumer who walks every aisle knows what I mean by this because they are subconsciously on the treasure hunt.

By adding these special deal items to the cart, the total amount of spend at the cash register increases. This behavior contrasts sharply with the type of consumer who has the discipline to load up on every day consumables at everyday low prices. I am convinced that the latter type of consumer does win in the end even if the cost of the membership is factored into the equation. As a supply chain professional, I will now explain my conviction using facts and figures that of course never lie.

Below is a chart that depicts Costco’s sales revenues and sales, general and administrative (SG&A) expenses over the past six years.

On Costco’s consolidated income statement, SG&A expenses include all pre-tax operating expenses to move products to market excepting the cost of store preopenings and interest expense. Therefore SG&A includes all operating costs including the cost to run the distribution depots, as well as all inbound and outbound transportation expense to move goods through the supply chain. From the chart below we can see that Costco spends about 10% of sales revenue on SG&A expense which is quite frankly one of the lowest retail spending rates out there.

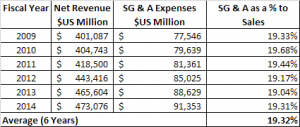

For the sake of comparison, Walmart’s global figures are shown in the table below to put this into perspective. For the past six years Walmart has averaged 19.3% SG&A expense and we all know that Walmart is widely considered to be a global leader as far as supply chain efficiency is concerned.

Lastly, just for fun, Amazon’s figures are shown in the table below. For the past six years Amazon has averaged 22.2% operating expense as a percent to sales (or 11.4% fulfillment expense as a % to product sales). It is important to draw the distinction between fulfillment expense and operating expense for Amazon since neither of these figures are directly comparable to Costco or Walmart. This is because Amazon’s revenues are derived from a combination of product sales, fulfilment services (FBA) and services revenues such as cloud computing. Having said this, at the end of the day, when Amazon sells $100 of products and services, they generate $22.17 of operating expense and this compares directly to the to $9.99 spent by Costco.

How does Costco keep operating expenses so low?

To answer this question, one needs to understand the company’s supply chain and how it differs from other retailers. It is a learning lesson that we can all benefit from.

The secret sauce to Costco’s supply chain is the concept of eliminating fingerprints on the product.

Imagine for a moment that every time a human being touched a case of merchandise between the source of supply and the store shelf, there is a set of brightly coloured fingerprints on the box - so that we can quickly count the number of touches incurred throughout the product’s supply chain voyage. Quite simply, the more fingerprints on the box, the more money that is spent moving the box to the store shelf. Costco has figured out how to minimize the fingerprints – plain and simple.

Costco operates a mix of distribution facilities to accomplish the overall objective of operating with an efficient supply chain.

An integral component of Costco’s supply chain efficiency is the cross dock distribution (depot) facility.

Costco purchases the majority of their merchandise directly from manufacturers and routes it through a network of cross-docking facilities which act as vendor consolidation points to move goods in full truckload volumes to the stores.

Depots receive truckload or container-based shipments from manufacturers

Goods are allocated and then shipped to stores , generally in less than twenty-four hours.

To the greatest extent possible, goods are handled through the depots in full pallet quantities meaning that a forklift handles a full pallet of merchandise at receiving and at shipping without the need for people to touch individual cases.

While this is not possible for 100% of the product lines (e.g. high dollar value items with low movement are generally the exception), the emphasis is definitely on minimizing touches.

At the warehouse stores, forklifts move pallets into racks such that the first time an item is physically touched is when the consumer reaches into the rack to pick the item and place it into their cart.

Thus the first time that a Costco employee touches product is at the cash register for most (but not all) of the items being sold.

Contrast this approach to the traditional multiple-step supply chain that may include some or all of the following activities:

*Manufacturer produces goods that are shipped to a distributor or middleman in full truckload or less than truckload shipment quantities such that there is a shipping inefficiency combined with multiple touch points at both the shipping and receiving ends of the transaction.

*Distributor then ships to the retailer distribution centre in full truckload or less than truckload shipment volumes such that full cases are picked and shipped by the distributor with inbound pallets being received, putaway and then replenished to pick slots by the retailer.

*Retailer then picks store orders in full case quantities such that every case has a set of fingerprints regardless of whether the product is picked to a pallet or to a conveyor system.

*Many products are handled within the retail distribution centre in “split case” quantities whereby the stores order retail units or inner packs of slower moving / higher cost items as a means to minimizing the inventory assets held at retail. This means there can be many touches for a single carton of merchandise.

*At the store, the case is touched again at the backroom as it is sorted and later on the store floor when it is opened and replenished to the store shelf.

In the traditional supply chain, some or all of the above steps combined add a substantial amount of cost to move goods through the supply chain.

One way of thinking about this is to add 25 cents of cost to each case of merchandise every time a person touches the box. This is why Costco saves money. They have figured out how to minimize the fingerprints.

Limitations to Costco's model

Now it is important to recognize that the Costco formula has its limitations.

1. It is predicated on moving massive volumes through few selling points therefore store formats are large in terms of footprint which is why they are called warehouses.

2. It is predicated on selling a limited variety of items which is known as “skimming the cream”. Only stock and sell the fastest selling products and only sell one packaging format per item which forces high volume consumption. Notice that toothpaste is sold in one format only – i.e. five large units stretch-wrapped together to force the consumer to buy more in the form of a five-pack.

3.The emphasis is on keeping costs down such that consumers are walking through a warehouse environment rather than a high-end supermarket. After all, moving full pallets of products requires forklift trucks to operate in the same aisles as consumers which creates limitations on the look and feel of the shopping environment.

Perhaps the only thing that Costco has not quite figured out how to do well is to build their parking lots big enough.

Regardless of the time of day or the day of the week, Costco parking lots across Canada are almost always busy with shoppers loading up on forward buys of consumables amongst other things. In fact, sometimes it can actually be a turn-off to shop at Costco because it is too hectic of an experience such as on Saturdays or during peak holiday shopping periods.

The lesson to be learned from Costco for every manufacturer, distributor or retailer, regardless of industry, is to figure out how to eliminate the fingerprints within your supply chain and within your internal processes.

If you can figure this out then you stand to gain the type of competitive advantage that has enabled Costco to become the third largest retailer in the U.S. in only 30 years.