2023 Grocery IQ Study: What Canadians really think about grocery shopping (part one)

To best serve shoppers, understanding what they want is essential. While that strategy might seem like a no-brainer, shoppers can be a tricky bunch whose needs and preferences seem to be always changing. What’s a grocer to do? To help, Canadian Grocer has once again teamed up with the research team at EnsembleIQ (Canadian Grocer’s parent) to bring you the 2023 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours. In this, our third-annual study, we surveyed 1,000 shoppers (primary and shared decision-makers) across Canada to shed light on how they size up the grocery shopping experience today and how they plan to shop in the future.

Below are some highlights from the study. Read part two here and part three here.

Feeling the pinch

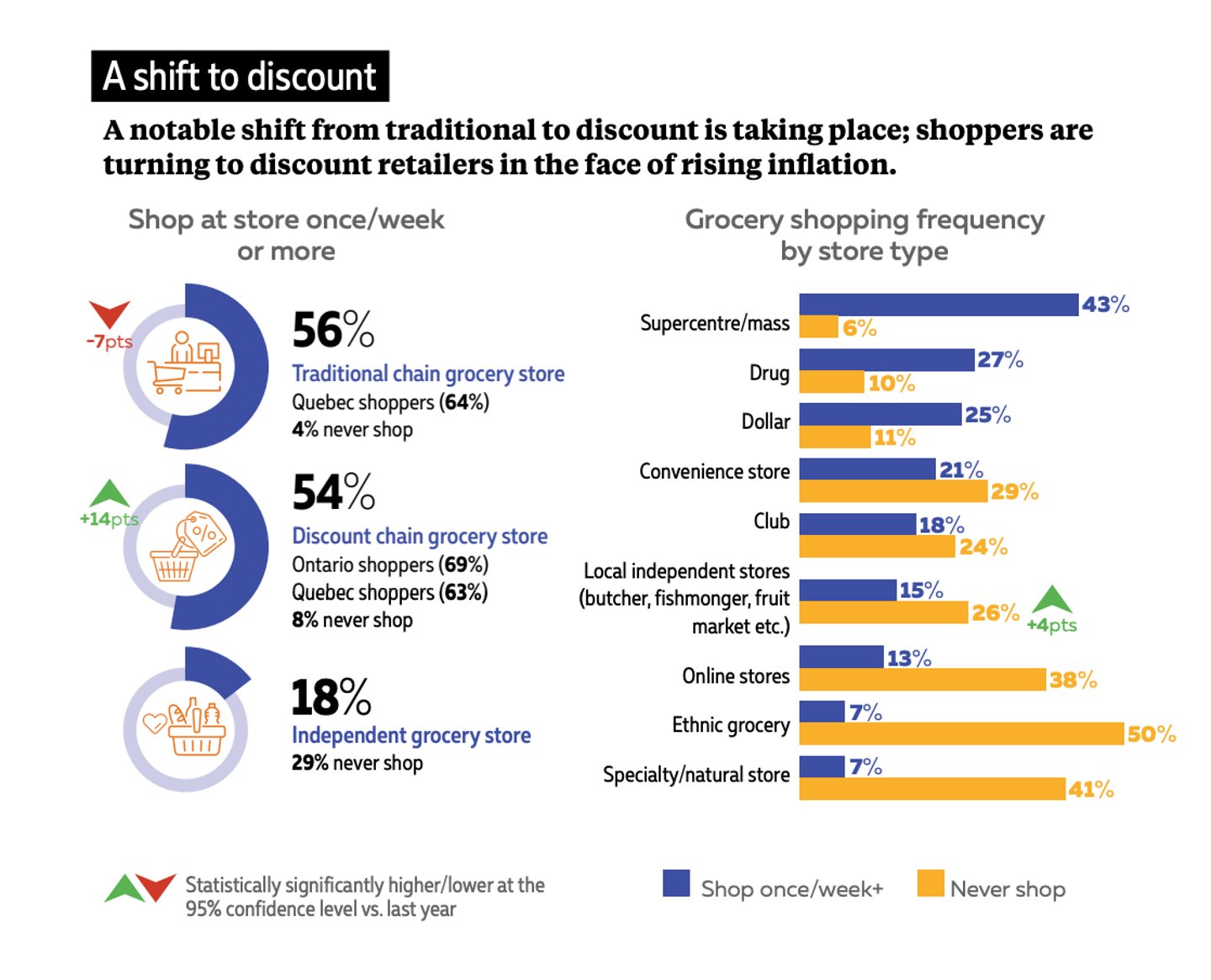

With reports of sky-high inflation and a looming recession dominating headlines for the last several months, it’s no surprise that consumers are feeling squeezed, and this reality is influencing how they shop for groceries. The latest edition of the Grocery IQ study reveals a notable shift from traditional to discount grocery stores, with 54% of survey respondents indicating they shop at a discount chain once a week or more, up a significant 14% from last year (and up 17% from our 2021 study) as shoppers prioritize value. Meanwhile, fewer respondents said they shopped at a traditional chain store once a week or more (56% compared to 63% last year).

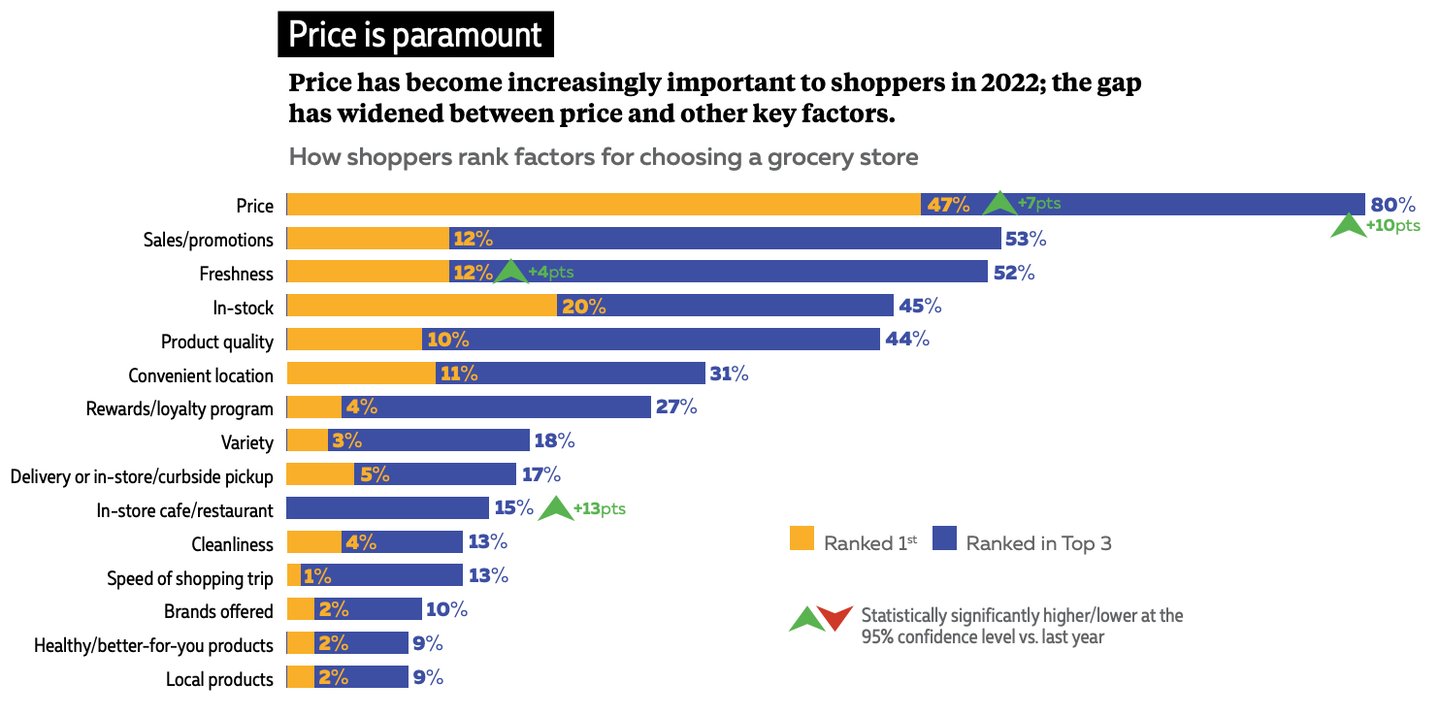

Against this tough economic backdrop, it’s hardly a surprise that when we asked shoppers “What is the most important factor when choosing a grocery store?” price, by far, was the most important consideration for 84% of those surveyed, up slightly from 82% last year. Other important factors for shoppers are product freshness (75%); products needed are in-stock (74%); sales and promotions (73%, up from 71% last year) and product quality (73%).

Room for improvement

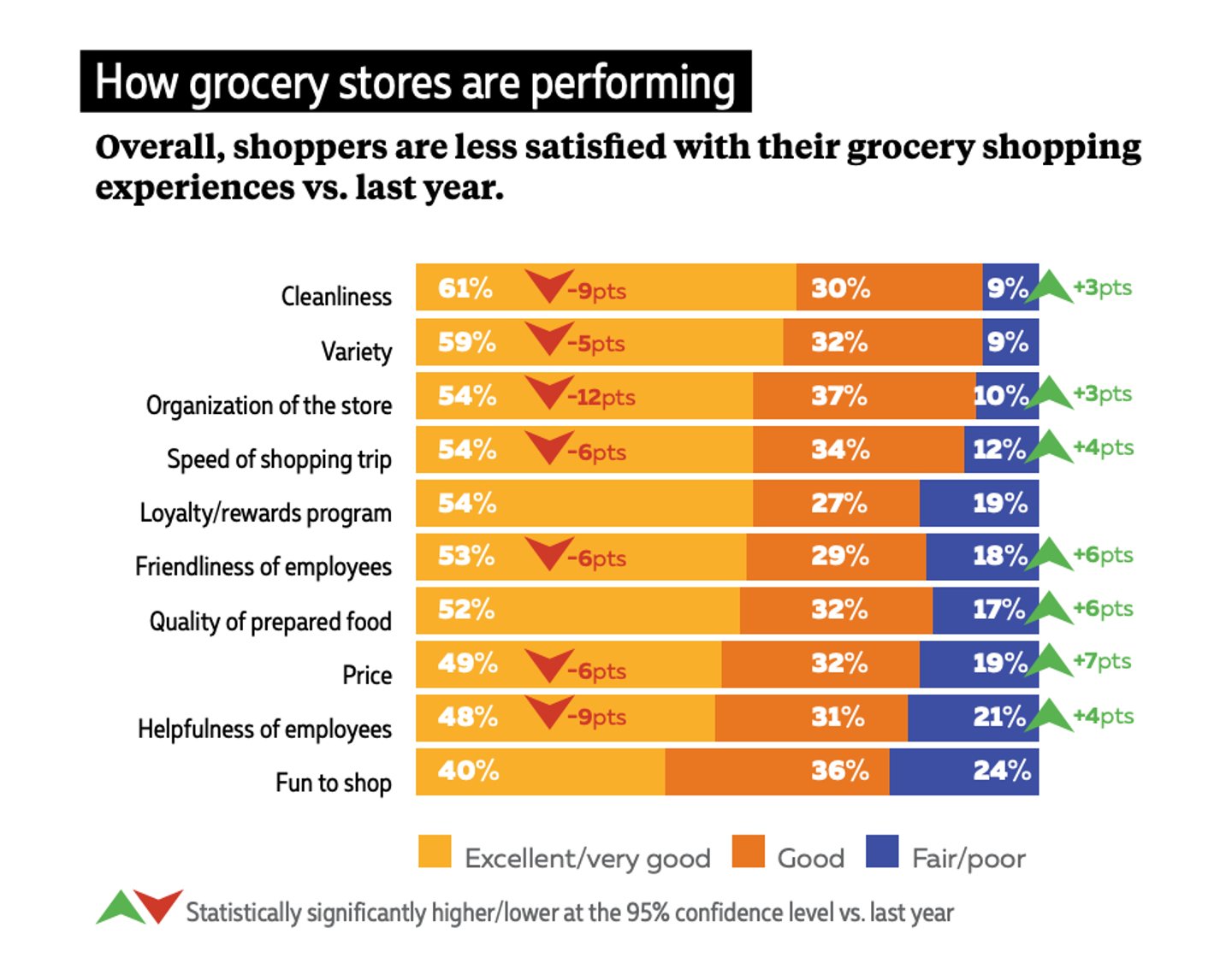

While grocery stores were generally rated favourably by shoppers last year, achieving high ratings in areas like cleanliness and store organization, this year they were harder to please. The 2023 Grocery IQ study reveals that, overall, shoppers are less satisfied with their grocery shopping experience. In particular, shoppers are less impressed with store cleanliness with 61% of shoppers perceiving this to be excellent/very good compared to 70% last year. Other notable declines were the variety of products available, organization of the store, high prices and the helpfulness of employees – all things for grocers to keep an eye on.

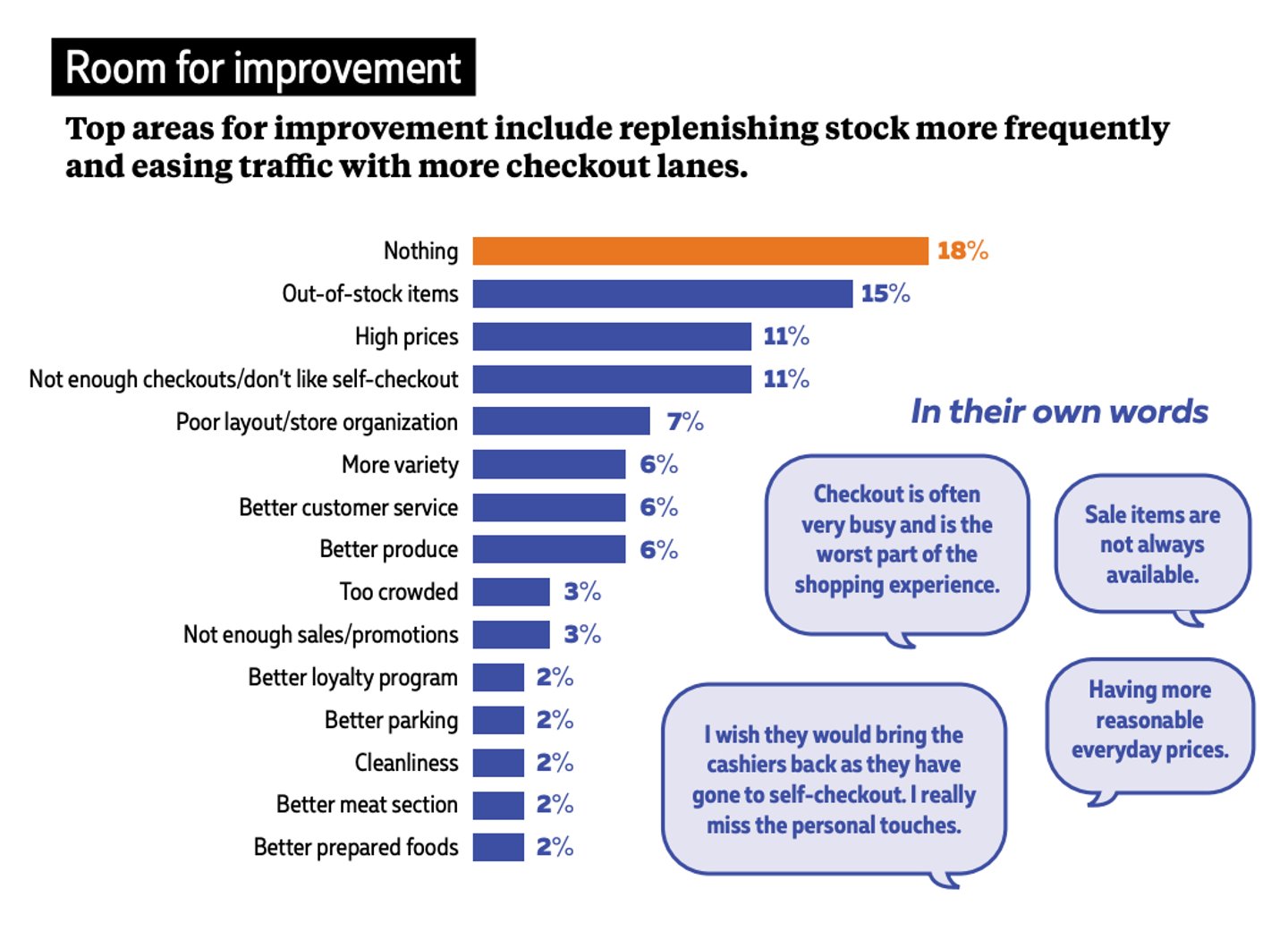

We also asked shoppers to tell us about their biggest pet peeves or what most needs improving at the store they shop most often. While their responses were fragmented, top areas identified for improvement were the usual suspects: out-of-stocks, high prices, and not enough checkouts. On a positive note, 18% of shoppers surveyed are happy with their primary grocery store’s performance and say it needs no improvement.

The lowdown on loyalty programs

Amid fierce competition in the grocery industry, the battle for customer loyalty is heating up. In recent years, retailers have launched innovative programs or tweaked existing ones to give customers a more compelling reason to choose them for their grocery shop. The question, however, is how do Canadian shoppers view loyalty programs? The good news is that loyalty program participation and satisfaction remain stable when compared to last year, with 67% of shoppers actively enrolled in their primary store’s loyalty scheme and more than 90% of those shoppers indicating some degree of satisfaction with the program. And there are interesting generational behaviours to note around loyalty programs; for instance, the study revealed that generation X (71%) and boomers (71%) are significantly more likely to be enrolled in a loyalty program than millennials (61%).

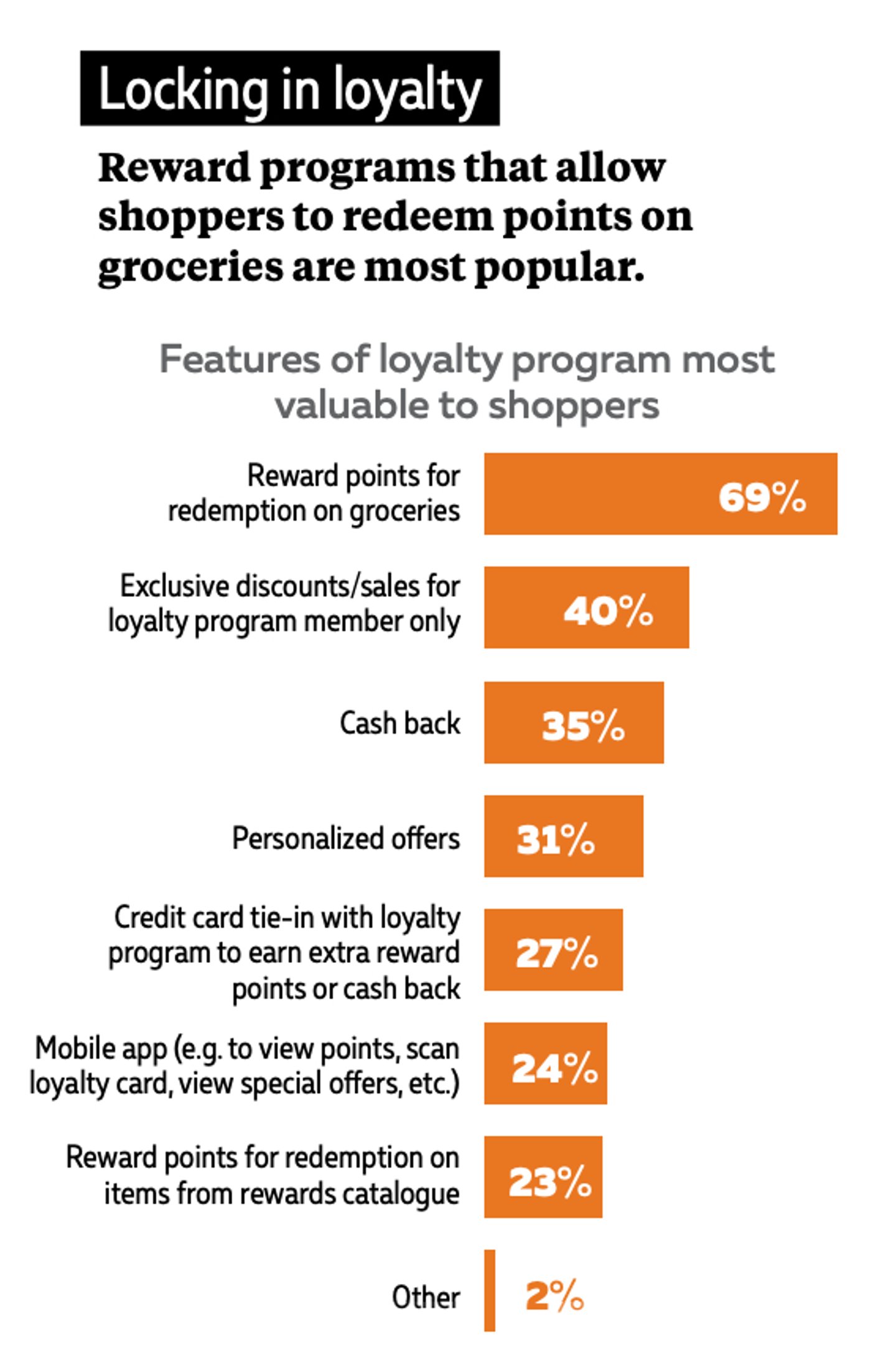

Digging a little deeper into loyalty, we asked shoppers to tell us what features of these programs they value most. By far, for those shoppers enrolled and actively participating in a loyalty program, the most important feature is the ability to redeem reward points on groceries (69%). Other popular features are exclusive discounts for loyalty program members (40%) and cash back (35%). It’s worth noting that Quebec shoppers value cash back more than shoppers in the rest of Canada, with 55% deeming it the most valuable feature.

Of course, loyalty programs don’t appeal to everyone. Reasons shoppers gave for not being interested in a store’s program are: requires too many purchases to earn rewards/points (22%); the rewards/points/discounts are not valuable (20%); requires signing up for a credit card (19%); and they already belong to too many loyalty programs (16%). Bottom line: holdouts need to be persuaded there’s substantial value to be gained by the loyalty program before they’ll consider joining.

This article first appeared in Canadian Grocer’s February 2023 issue.

Overview and methodology

- Survey sample: 1,000 grocery shoppers

- Respondents were required to be age 18+, reside in Canada, shop at grocery stores at least once a month and are the primary or shared decision-maker for household grocery shopping

- Quotas were established by province/ territory to accurately represent the population distribution of Canada