2023 Grocery IQ Study: What Canadians really think about grocery shopping (part two)

To best serve shoppers, understanding what they want is essential. While that strategy might seem like a no-brainer, shoppers can be a tricky bunch whose needs and preferences seem to be always changing. What’s a grocer to do? To help, Canadian Grocer has once again teamed up with the research team at EnsembleIQ (Canadian Grocer’s parent) to bring you the 2023 Grocery IQ Study: Taking Stock of Grocery Shopper Attitudes and Behaviours. In this, our third-annual study, we surveyed 1,000 shoppers (primary and shared decision-makers) across Canada to shed light on how they size up the grocery shopping experience today and how they plan to shop in the future.

Below are some highlights from the study. Read part one here and part three here.

In-store and online

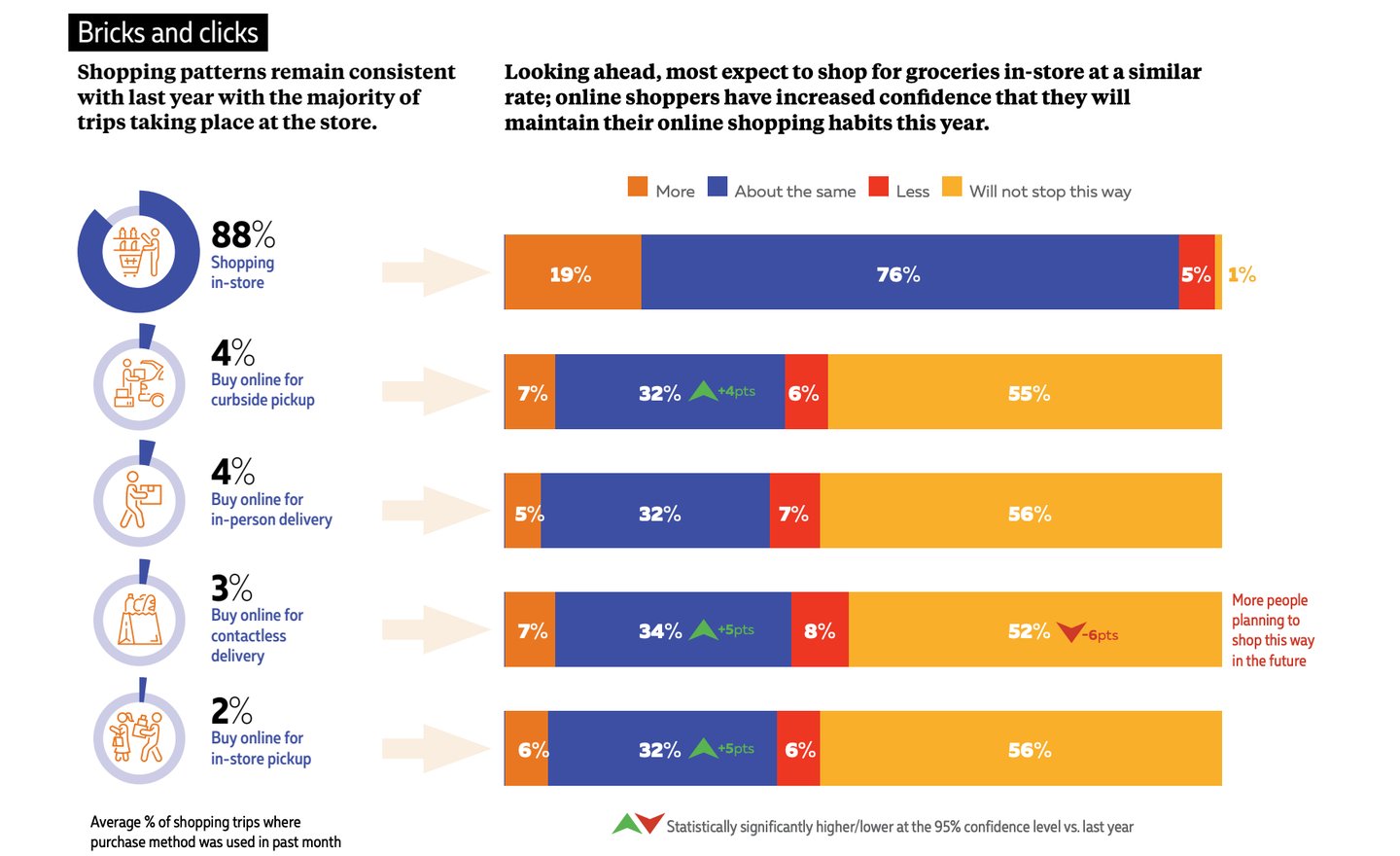

It’s no surprise that Canadians continue to rely, overwhelmingly, on physical stores to procure their groceries. In fact, 97% of those surveyed indicated they had shopped in the store in the past month, a figure that has not budged over the past three years of the study. Looking at the online options available, the survey revealed that curbside pickup and in-person delivery were neck-in-neck with each accounting for 4% of shopping “trips” in the past month.

When we asked shoppers how they think they’ll shop in the year ahead, most respondents (76%) said they expect to shop for groceries in-store at a similar level as they do today, with 19% saying they expect to shop in-store more often. Online shoppers also anticipate maintaining similar online behaviours in 2023. A bright spot for grocers is that satisfaction remains relatively high for online grocery shopping, with 89% of shoppers in this space claiming some level of satisfaction. For the 11% not happy with the experience, the biggest peeves are high fees (42%, up 9% from last year), outof-stocks (41%) and dissatisfaction with product substitutions (27%). On a more positive note, fewer of these shoppers (15% vs. 23% a year ago) said their order was picked incorrectly.

Shopping today and tomorrow

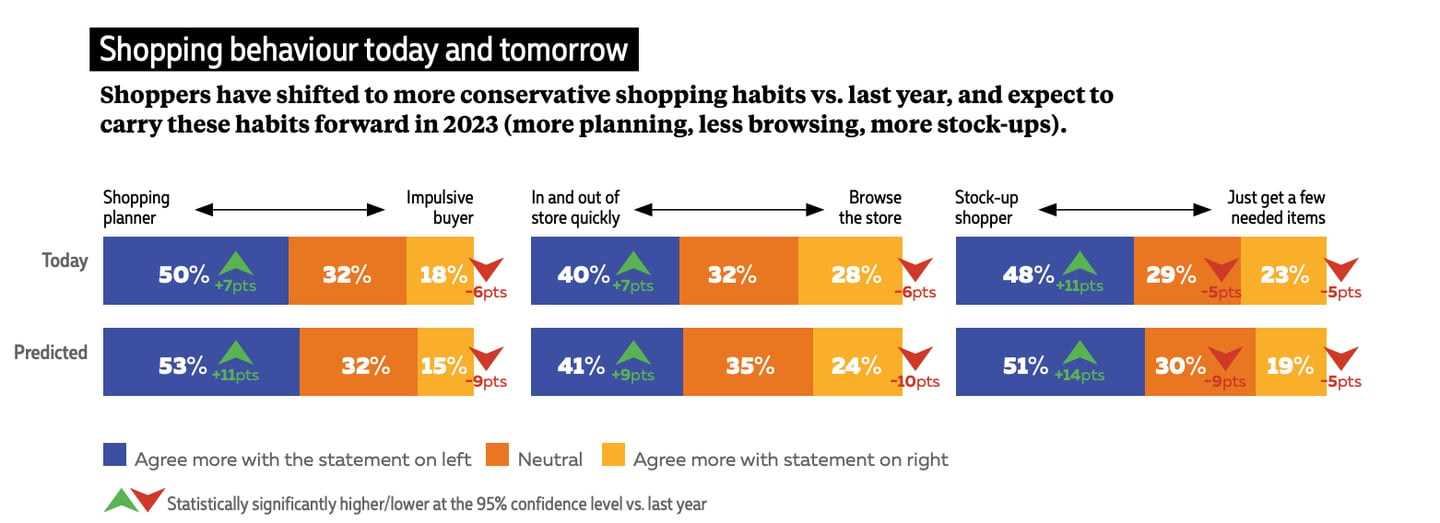

Given the economic pressures Canadians are contending with, it stands to reason that they’re demonstrating more conservative shopping behaviours compared to last year. In fact, more shoppers report they’re planning their trips to the store, they’re stocking up, are spending less time browsing the aisles and are less inclined to add impulse items to their baskets. Shoppers also expect they’ll maintain these habits through 2023.

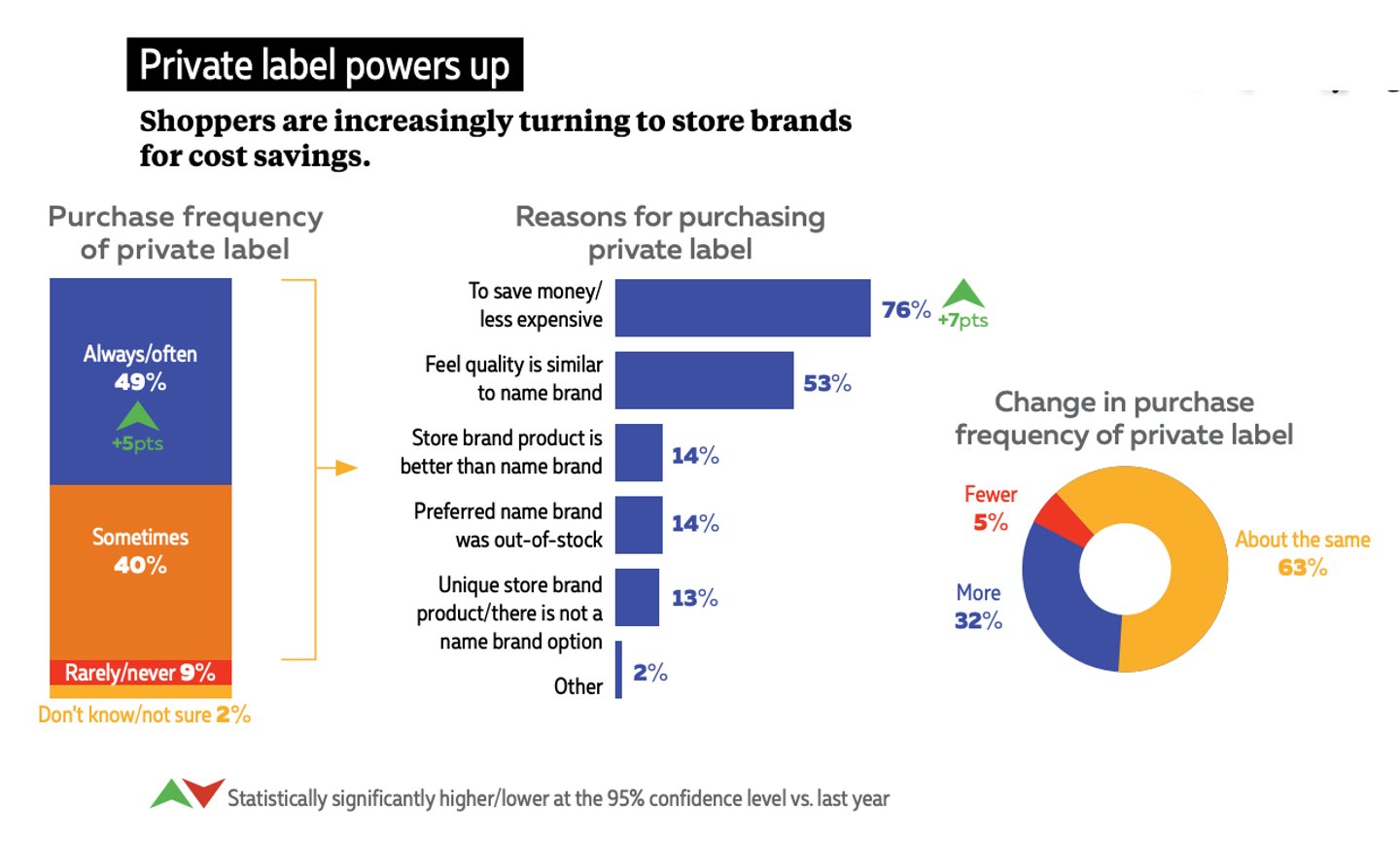

To cope with high costs, shoppers also appear to be leaning into home cooking and flexible meal plans to manage their food budgets. The survey revealed 57% of shoppers are cooking more from scratch, up 11% from last year, with 59% anticipating they’ll continue to do so. Perhaps another sign of the times is the growing popularity of private label; according to the survey, more shoppers (32% vs. 21% a year ago) say they’re buying store brands and predict they’ll buy them at a similar level going forward. The top reasons shoppers give for purchasing private label are to save money (76% compared to 69% last year) and they feel the quality of these items is similar to name brands.

What’s in the basket?

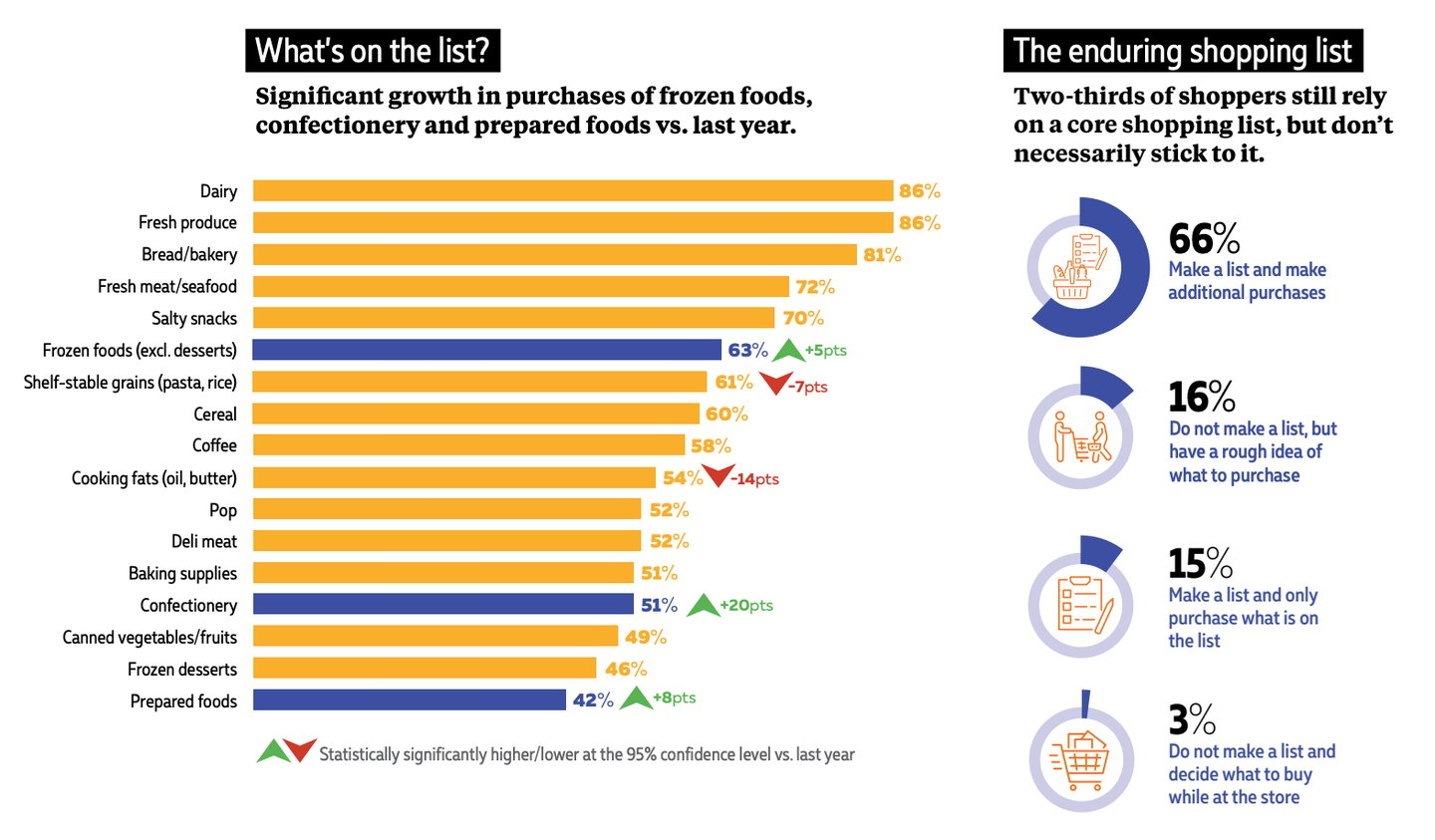

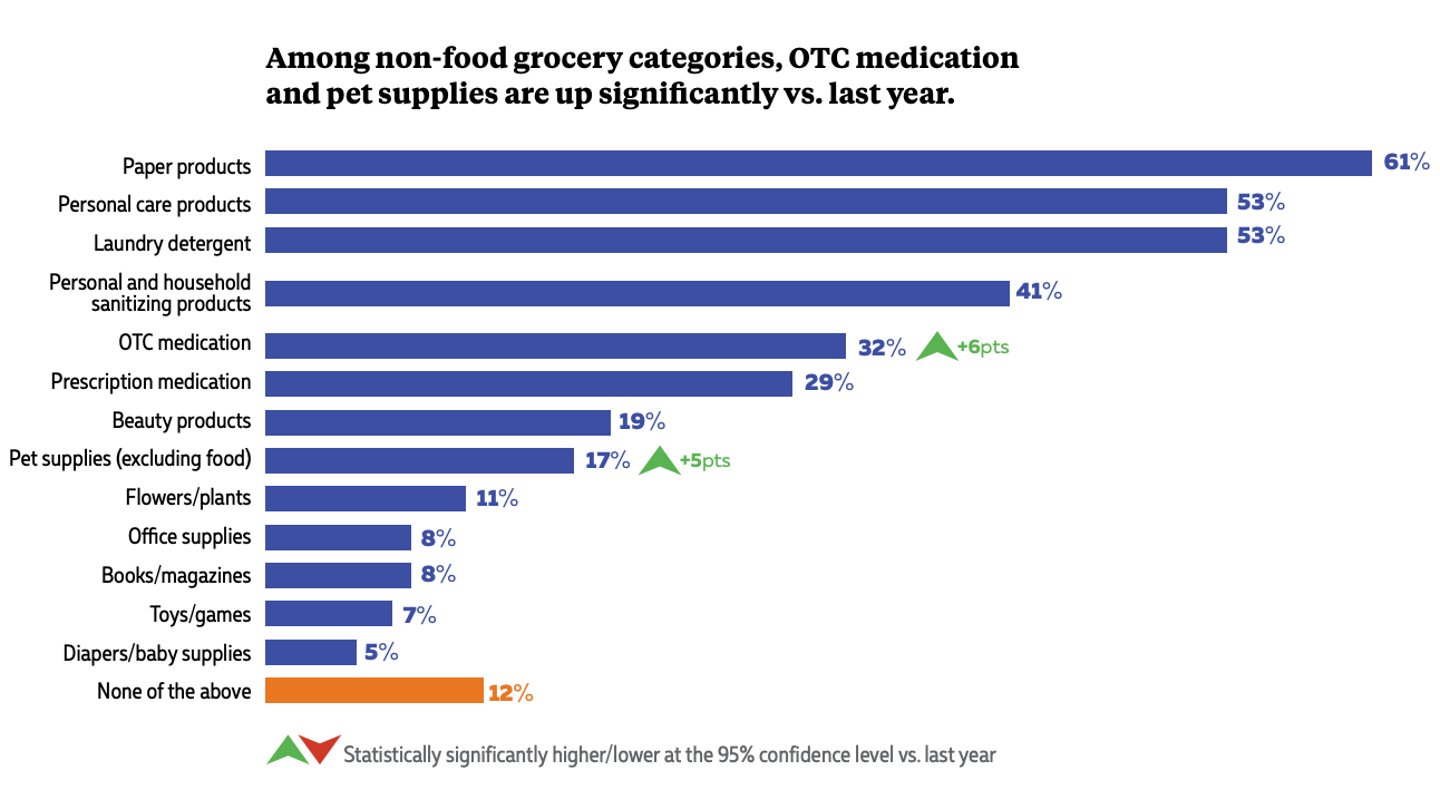

Canadians continue to load up on fresh with 86% of shoppers purchasing dairy and fresh produce in the past month, with nearly three-quarters reporting to have added fresh meat and seafood to their carts, consistent with last year. Notable shifts were observed in frozen foods with significantly more shoppers buying them this year (63% vs. 58%) as well as confectionery (51% vs. 31%) and prepared foods (42% vs. 34%) indicating, perhaps, that shoppers are turning to affordable luxuries in tough times. Among the non-edible products purchased at grocery stores, paper products remain the most purchased items, however, over-the-counter medications and pet supplies saw the biggest increases over last year at 32% (up 6%) and 17% (up 5%), respectively.

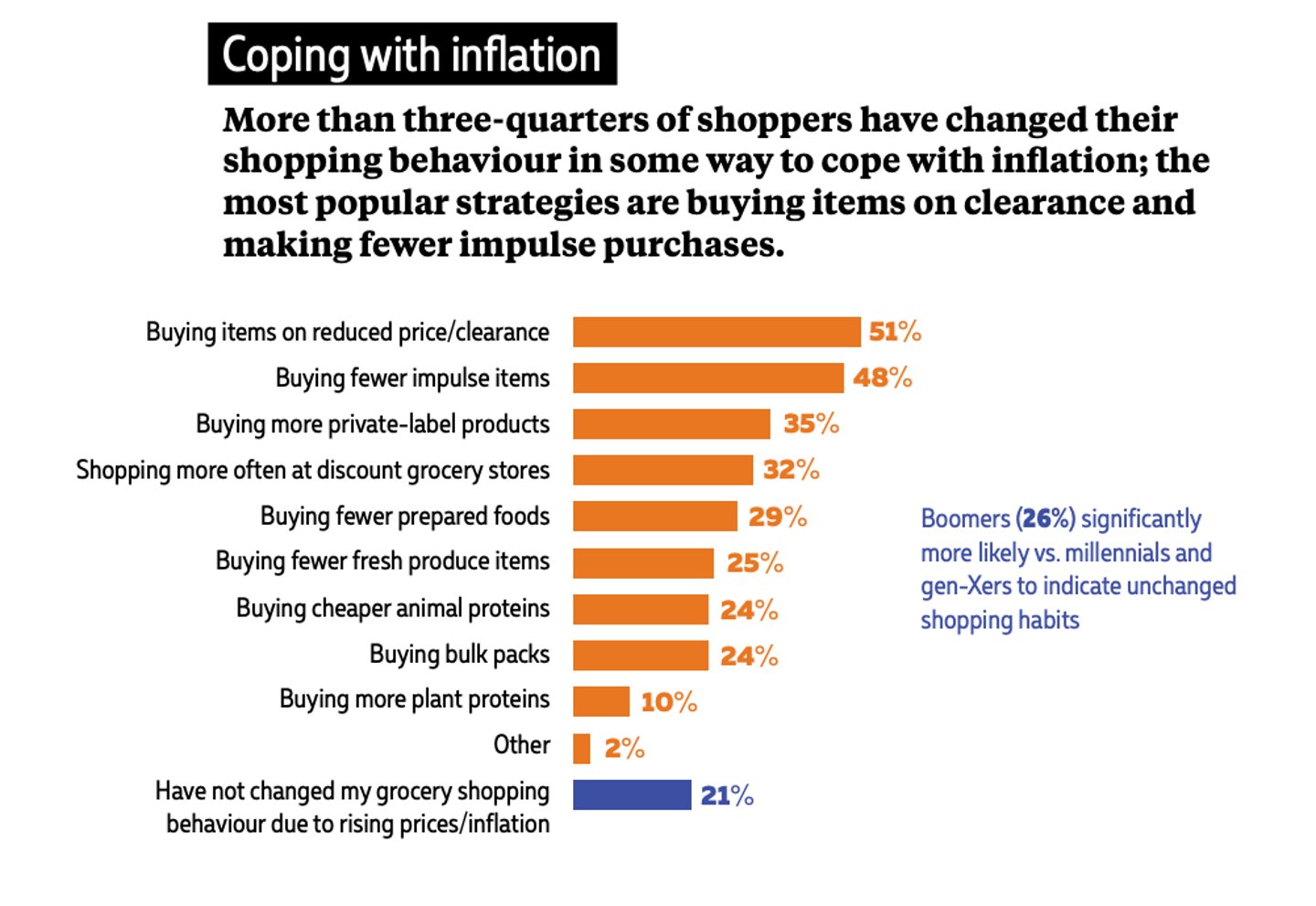

On average, Canadian shoppers reported spending about $112 on their most recent grocery trip, up slightly from $109 a year ago. When asked about changes they’ve made to cope with inflation, more than three-quarters indicated they’ve adjusted their shopping habits in some way. Among the top strategies used by shoppers: buying clearance items, fewer impulse items, more private label, and shopping more frequently at discount grocery stores. Looking at it through a generational lens, the survey revealed that boomers are significantly more likely than millennials and generation-Xers to report no changes to their shopping habits.

This article first appeared in Canadian Grocer’s February 2023 issue.

Overview and methodology

- Survey sample: 1,000 grocery shoppers

- Respondents were required to be age 18+, reside in Canada, shop at grocery stores at least once a month and are the primary or shared decision-maker for household grocery shopping

- Quotas were established by province/ territory to accurately represent the population distribution of Canada