A look at food spending and provincial tax rates

As Canadians sit down to their dining tables, the financial burden of what lies on their plates extends beyond mere calories. Recent data from Statistics Canada paints a stark picture of household disposable income being consumed by food retail across the provinces, with a noteworthy correlation to the tax rates levied upon their earnings.

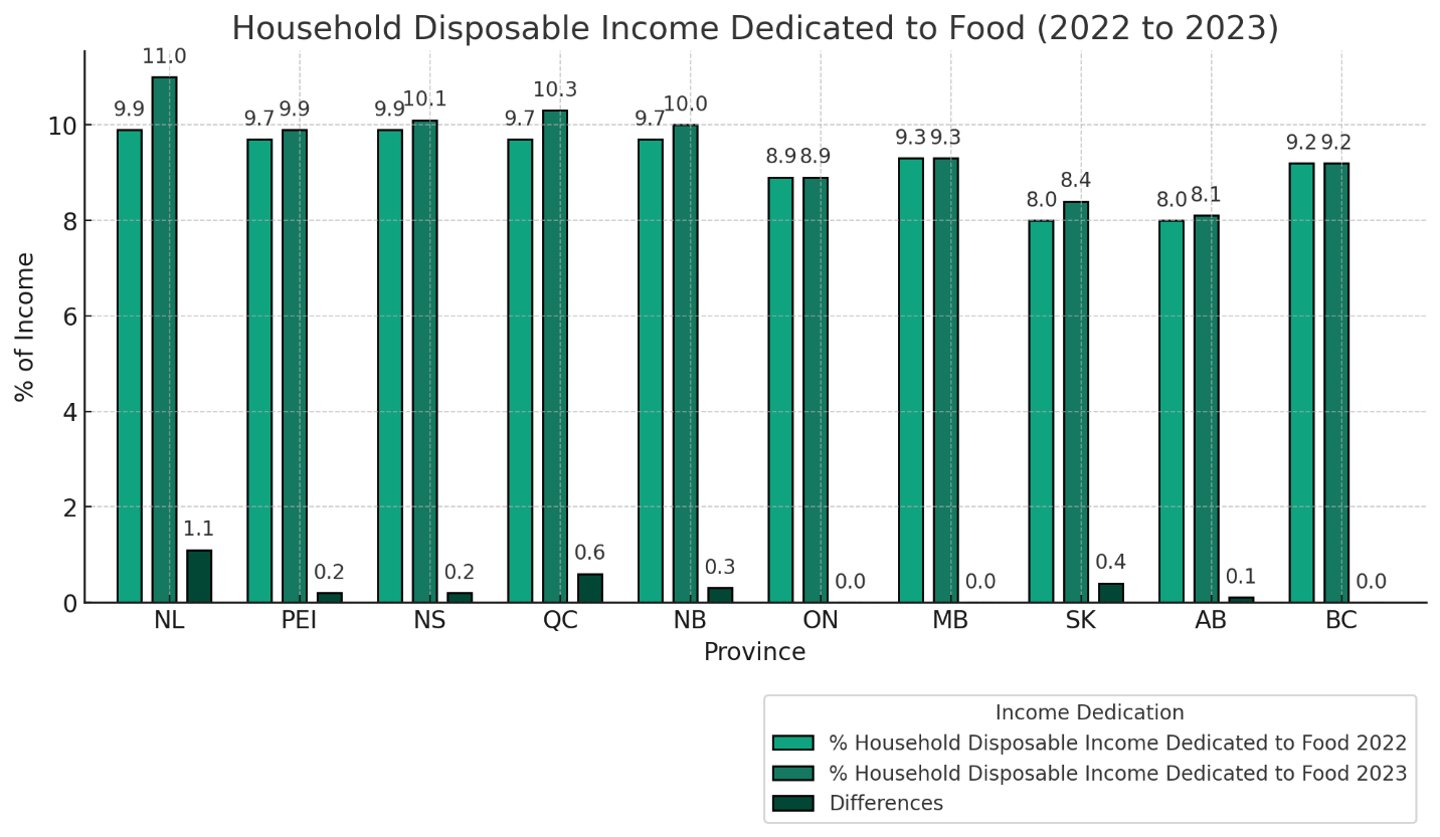

The bar chart representing the percentage of disposable income spent on food retail in 2022 and 2023 shows Newfoundland and Labrador (NL) leading the charge, with 11% of household income dedicated to sustenance (up +1.1% from 2022). This is closely followed by Quebec (QC) (Up +0.6% from 2022), Nova Scotia (NS) (UP +0.2% from 2022), and New Brunswick (NB) (Up +0.3% from 2022), all hovering around the 10% mark. In stark contrast, Alberta (AB) expends only 8.1%, the lowest among the provinces.

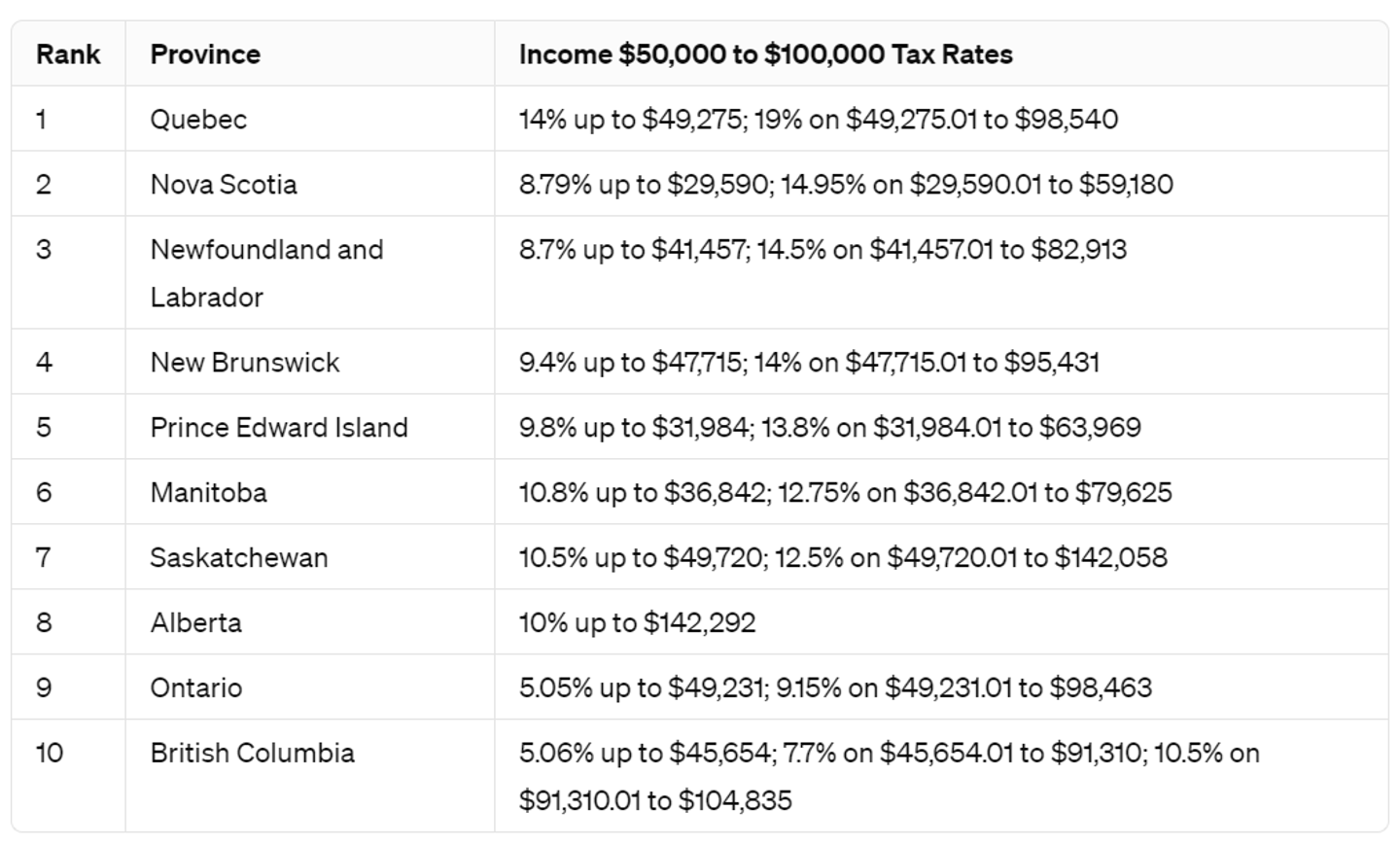

Simultaneously, a table detailing the income tax rates reveals a story in parallel. Quebec, despite its renowned culinary culture, imposes a notable tax burden on its residents, with rates climbing to 19% on income just shy of $100,000. This is the province where citizens dedicate a significant portion of their income to food, second only to NL, which also features higher tax rates compared to the national average.

Is it a mere coincidence that provinces with higher tax rates see a greater share of income going towards food? Or is this an indicator of a larger economic narrative where the tax burden intersects with the cost of living, amplifying the impact on disposable income and, consequently, on food affordability?

Consider this: taxes affect disposable income, which in turn influences purchasing power. The interplay is especially evident in the realm of food, a necessity that consumes more of the household budget in regions with higher taxes. The situation begs a question of policy and priorities: Are we taxing our way into tighter kitchen budgets?

READ: Many Canadians still feeling squeezed even as debt worries ease

Provinces like Alberta, with its lower tax rates, see a lesser percentage of income spent on food. This leaves room for investment in quality, nutrition, and diversity. It might also create a wider economic space for citizens to engage in other sectors, bolster savings, and stimulate local economies beyond the grocery store aisles.

Furthermore, there's an element that transcends the raw numbers. These figures do not only represent economic data; they reflect the lived realities of Canadian families. The percentage points translate into decisions about whether to buy fresh fruit or canned, organic or non-organic, local or imported. They influence lifestyle choices, dietary health, and, in broader terms, the wellbeing of communities.

Provinces and the Canadian government and policy makers must heed these statistics as more than fodder for fiscal debates. They are a call to action to balance the scales between taxation and affordability. With food prices continuing to escalate worldwide, there's a pressing need to ensure that tax policies don't inadvertently tighten the financial belts of Canadians around their dinner tables.

READ: Bargain-hunting on the rise in grocery

A policy reevaluation seems prudent, one that considers the cost of living, particularly food, in its formulation. It could be a step towards ensuring that families in Quebec, Newfoundland and Labrador, and indeed across all provinces, are not disproportionately burdened by a basic human need.

As we navigate the complex web of economic policies and their social consequences, Canada stands at a crossroads. Will the country adjust its fiscal policies to nurture not just a healthy economy, but also a healthy populace? The data is on the table, and it’s time for a national conversation about the recipe for a balanced, affordable, and nutritious food environment for all Canadians.